Disability insurance

What’s disability insurance? It protects your ability to earn a living. If you get too sick or injured to work, it replaces a portion of your income so you can pay your bills. Disability is more common than you may think: about 5% of working Americans experience a short-term disability each year — and most don’t originate at work, so they aren’t covered by workers' compensation.1

Get disability insurance for yourself

Help protect the lifestyle that you've built through a long-term disability plan, whether you're self-employed or looking to supplement coverage from work.

Get disability insurance for employees

Help protect the financial wellness of employees with short-term, long-term, and paid family leave coverages that can be managed in lockstep with other leave requirements.

A history of protecting

Why choose Guardian for disability insurance?

Guardian has been helping families protect their financial well-being for over 160 years. With high scores for financial soundness from independent rating agencies,* our 12 million customers can trust us to be there when they need us most.2

Why every working adult may want to consider disability insurance

What would happen if you were suddenly unable to work and earn an income? Accidents and injuries happen, and we can’t always anticipate if or when we’ll be diagnosed with a serious illness or medical condition. A disability policy can help protect you and your family by providing income to help pay your bills if you can’t collect your normal paycheck.

Disabilities are often more common than you may think

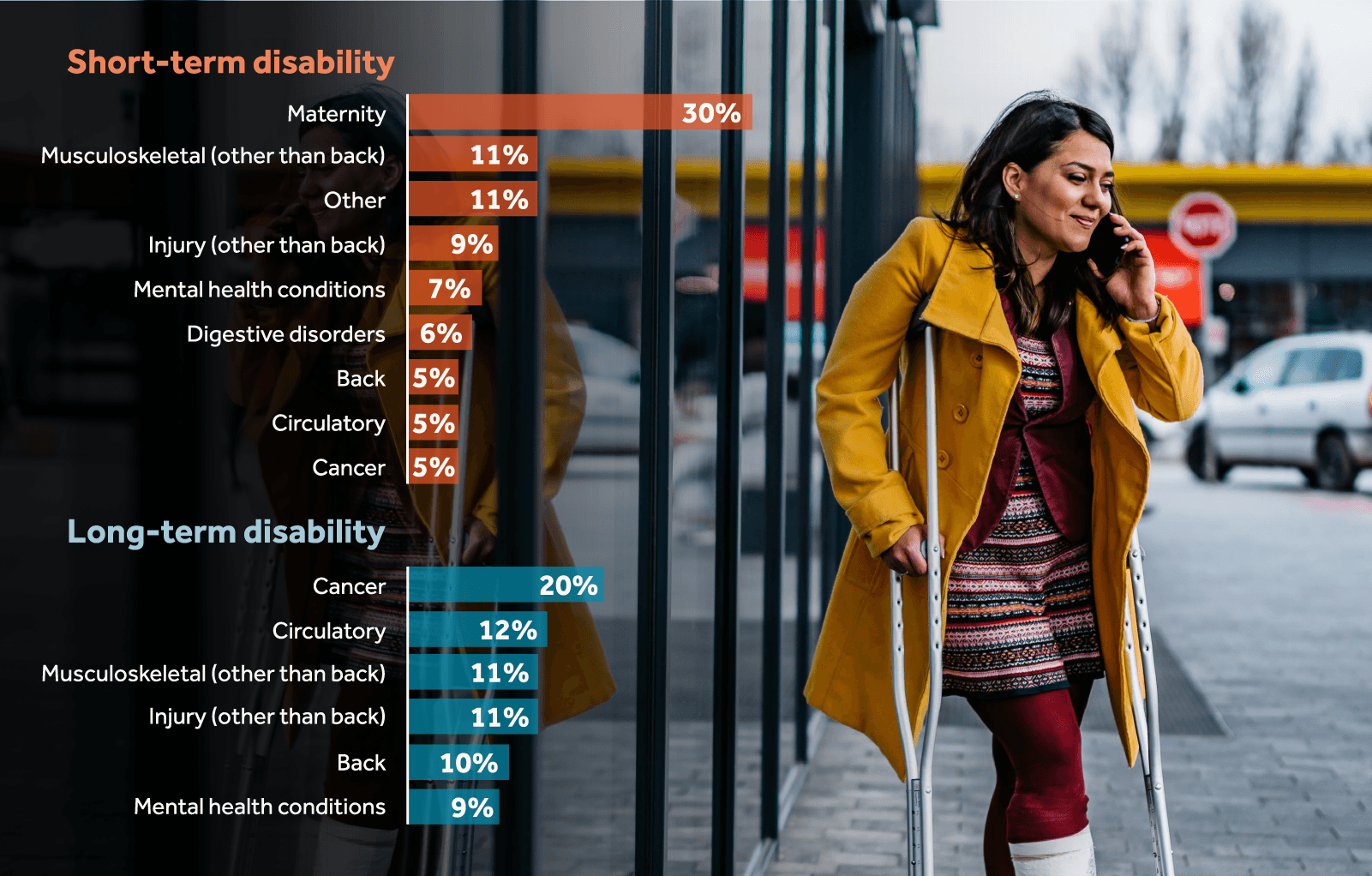

While the term “disability” is sometimes applied to catastrophic conditions, such as paralysis from a car accident or a debilitating stroke, it covers far more conditions than you might think. Disabilities are more typically the result of less severe injuries, and people often need disability coverage for more common conditions such as pregnancy, back pain, depression, and digestive disorders.

Leading causes of disability claims*:

FAQ

Top questions about disability insurance

Being disabled doesn’t mean unable

Meet Dr. Feranmi Okanlami. After suffering an unexpected accident, his disability insurance helped him continue to pursue his dream, while also opening up new avenues for him to find success. Watch his story to find out more.

Income protection supports financial wellness

Around 5% of working Americans a year will experience a short-term disability leave due to a pregnancy, injury, or illness.3 The truth is that people of all ages, demographics, and professions have roughly the same potential to experience an income-disrupting injury or illness. More than 25% of today’s 20-year-olds can expect to become disabled and be out of work for at least a year during their career.4

Get disability insurance for your employees

Learn more about how group disability insurance can support the financial wellness of your workforce.

Life insurance

If people depend on your income for support, what will happen to them if something happens to you? Life insurance can be a vital source of financial support.

Dental insurance

Dental insurance helps keep your mouth and body healthier by covering regular preventive oral care. And it helps cover costs every time you visit the dentist — even if you need major work.

Supplemental health insurance

Supplemental health benefits can offer an economical way to support well-being when employees are faced with unforeseen challenges, like an accident, illness, or injury.

Accident insurance

Accident insurance can help with extra expenses if an accident happens to you or a covered member of your family.

1 Disability Statistics, Council for Disability Income Awareness, 2025

2 https://www.guardianlife.com/financial-highlights

3 Disability Statistics, Council for Disability Income Awareness, 2025

4 ibid

*Ratings are as of 2025 and are subject to change.

Material discussed is meant for general informational purposes only and is not to be construed as tax, legal, or investment advice. Although the information has been gathered from sources believed to be reliable, please note that individual situations can vary. Therefore, the information should be relied upon only when coordinated with individual professional advice.

Links to external sites are provided for your convenience in locating related information and services. Guardian, its subsidiaries, agents and employees expressly disclaim any responsibility for and do not maintain, control, recommend, or endorse third-party sites, organizations, products, or services and make no representation as to the completeness, suitability, or quality thereof.

Individual disability income products underwritten and issued by Berkshire Life Insurance Company of America (BLICOA), Pittsfield, MA or provided by Guardian. BLICOA is a wholly owned stock subsidiary of and administrator for the Guardian Life Insurance Company of America (Guardian), New York, NY. Product provisions and availability may vary by state. Optional riders are available for an additional premium.

Guardian’s Group Disability Insurance is underwritten and issued by The Guardian Life Insurance Company of America, New York, NY. Products are not available in all states. Policy limitations and exclusions apply. Optional riders and/or features may incur additional costs. Generic Policy Form #s GP-1-STD-15; GP-1-LTD-15. The state approved form is the governing document. For NY, the Policy Form # is GP-1-DI-12R-NY.

Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.