Supplemental individual disability income insurance

Last updated July 24, 2025

What is supplemental disability insurance?

If you are like one of the millions of Americans who unexpectedly becomes unable to work each year due to illness or injury, the last thing you want to worry about is how to continue paying your bills without an income.

If you currently have disability insurance through your employer, that’s a great start towards protecting your income and lifestyle. But, for some individuals, that coverage may not be enough to cover your lost income in the event of a disability.

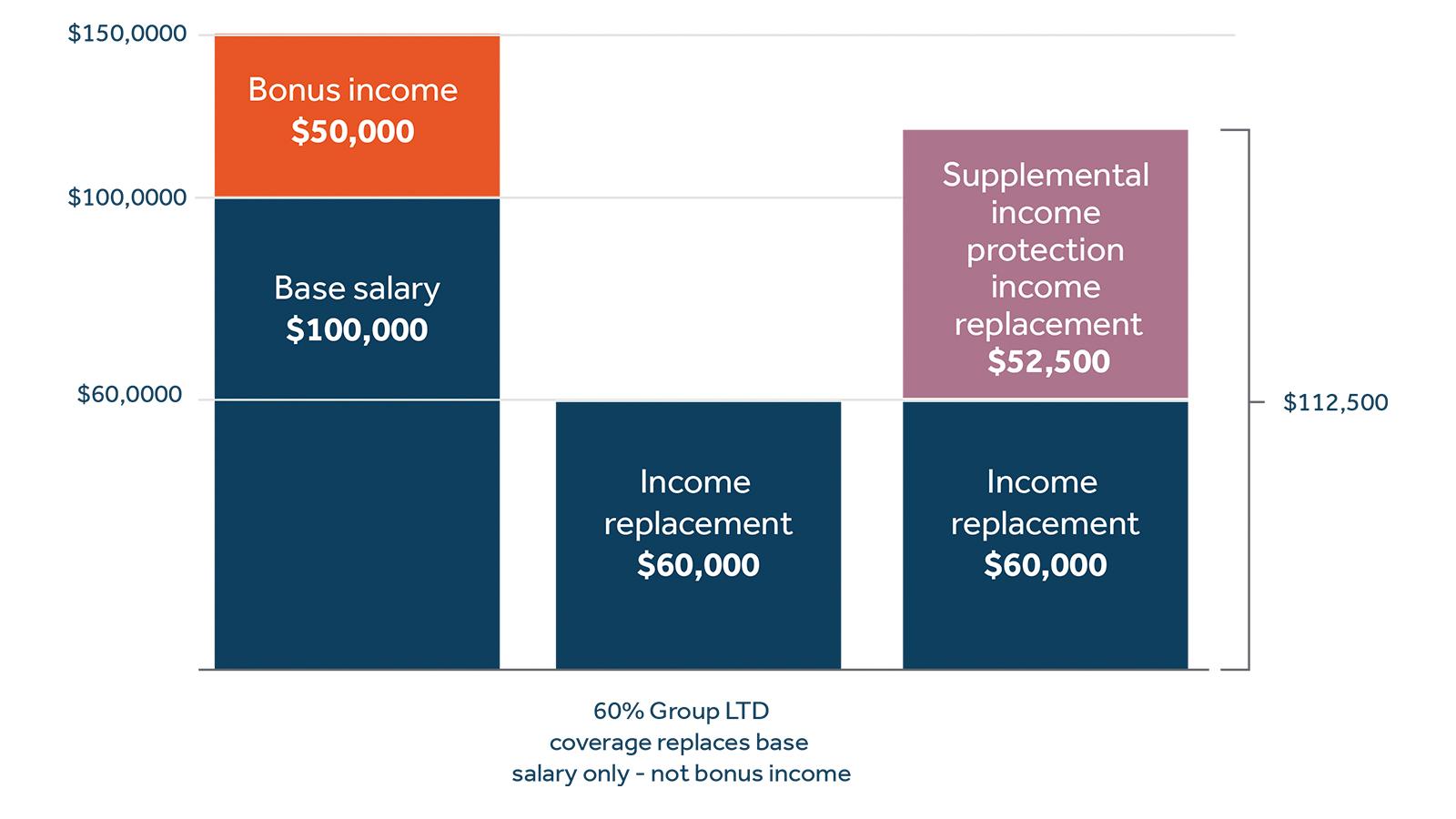

Supplemental disability insurance can be a great add-on for employees who wish to protect a greater percentage of their income, bonuses or commissions. In fact, supplemental disability insurance may be available through your employer.

This type of disability insurance helps cover the difference between what you’ll receive from your current long-term disability policy and what you’d need to maintain your current lifestyle if you’re unable to work due to injury or illness. Often, this is referred to as the income gap.

Get a long term disability insurance quote

Look at your employer’s group disability insurance policy

A good start to protecting your income is disability income insurance provided through – and often paid for by – your employer. Such a policy typically covers 40-60% of pre-disability salary, often up to a set benefits cap. Adding supplemental disability insurance can help you cover more of your expenses and help you maintain your lifestyle while disabled.

If you’re not sure what coverage you may already have, or how much salary it covers, you should reach out to your human resources team. While speaking to them, you can also ask if they offer a supplemental disability insurance plan.

Protecting the paycheck and career that you’ve built

Professionals have often invested heavily in their education and career development. Many have dedicated as much as many years to education and training, accumulating substantial student debt along the way. Individual disability insurance acknowledges this investment by providing more comprehensive protection of the income that the education and years of experience was designed to generate.

Why you may need it?

Nobody thinks it will happen to them, but one in four workers will become disabled during their working years.1 Luckily, there are a few ways to help protect yourself against the financial effects of becoming too sick or injured to work and earn an income. Additionally, it often lasts longer than expected. In fact, the average long-term disability absence lasts around 34.6 months. Here are a few other reasons to consider supplemental disability insurance:

Get a bigger safety net

Supplemental individual disability income insurance is tailored to your specific compensation and may cover your bonus and other incentives.

Individually-owned policy

It belongs to you, even if you change jobs, and can grow with your career and compensation.

No medical exam required

Applying for this coverage is easy, because there is no medical exam and you just need to answer three simple yes/no questions.

Your coverage and costs remain fixed.

As long as you make payments on time, your policy can’t be changed or cancelled.

Are you an employee? Contact your employer and ask if they currently offer supplemental disability insurance.

Are you an employer? If you’re interested in adding this attractive benefit for your employees, speak with a financial professional today.

Are you a broker or financial professional? Speak with one of Guardian’s disability experts today to learn more.