Comprehensive employee benefits for Professional Employer Organizations (PEOs)

Personalized PEO benefits solutions

The benefits your worksite clients want, delivered in a consultative, customizable way that considers the individual well-being needs of any company, at any size.

Improved worksite experience

A strategic, omnichannel approach to education, engagement, and enrollment that helps drive employee appreciation and participation rates.

When it comes to benefits, you need simplicity

Your worksites want a robust package. You need a seamless approach to deliver it. A partnership with Guardian can help provide both.

Now’s the time to prioritize the benefits you offer worksites

As a PEO, you work hard to help small and midsize business owners live their passions. Let us help you seamlessly offer the benefits your worksite clients need to attract and retain top talent. Especially when we know that 90% of small businesses that are hiring find it difficult to recruit qualified candidates for open positions.1

Seven in 10 small firms say that they are aiming to offer a better benefits package than their industry peers.³

80% of employers that work with a PEO say that improving their worksite employees’ financial security is their top priority.⁴

Individuals who work for smaller firms are more than 200x more likely to be dissatisfied with their benefits packages than their peers at larger firms.⁴

More than 1 in 5 (22%) small business employees say their organization’s current benefits communications are not effective at helping them make the right choices.⁵

Guardian is a proud NAPEO partner

We continue to strengthen our commitment to helping PEOs support small and midsize businesses by partnering with the National Association of Professional Employer Organizations (NAPEO).

Behind every PEO is a Guardian

Simplicity means more than just the latest processes and intuitive tools. It means having a partner to help your worksites better understand how their benefits can impact their well-being — driving enrollment while helping each employee to feel, think, and perform their best.

Let us help you continue supporting business owners pursue their passions, so they can focus on wowing their customers and caring for the people behind their thriving businesses.

Ryan Churchill

Senior Sales Executive - Large Market

PEO East

M: 727-254-6100

Ryan_Churchill@glic.com

Brendan Canning

Senior Sales Executive - Large Market

PEO West

M: 415-652-9990

Brendan_Canning@glic.com

Adelaide Kimberly

PEO Sales Consultant

M: 205-807-8233

Adelaide_Kimberly@glic.com

1,3 “Small and Resilient: Prioritizing workforce well-being in a challenging economic environment,” Guardian’s 11th Annual Workplace Benefits Study (2022)

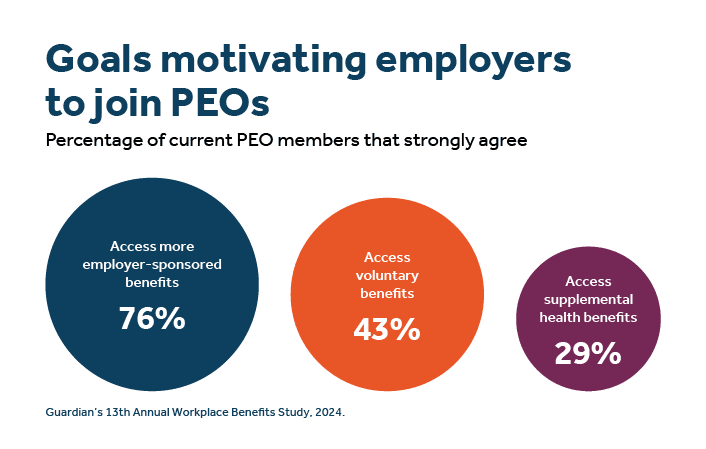

2,4 "The Power of PEO Partnerships," Guardian's 13th Annual Workplace Benefits Study (2024)

5 “Small and Resilient: Prioritizing workforce well-being in a challenging economic environment,” Guardian’s 11th Annual Workplace Benefits Study, 2022

Guardian’s Group Insurance products are underwritten and issued by The Guardian Life Insurance Company of America, New York, NY. Products are not available in all states.