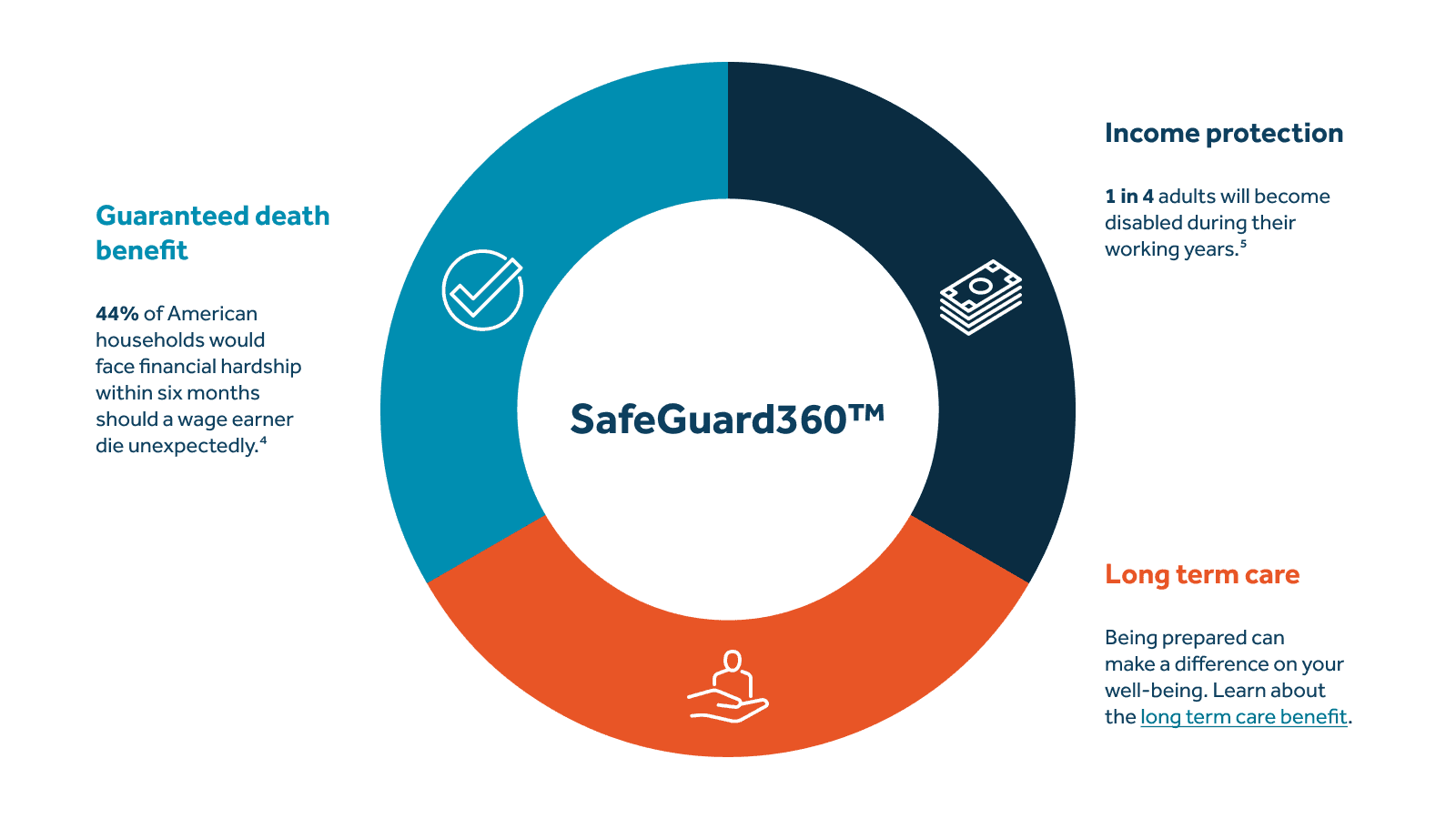

Guardian’s SafeGuard360™ combines the benefits of life insurance, long term care, and disability insurance to provide a single solution that offers holistic financial protection for every stage of life. It includes a streamlined application process and helps to address some of the foundational financial challenges most Americans face today. SafeGuard360™ provides:

A combination life insurance solution to support your financial wellness

Protecting you and your family means being prepared no matter what life throws at you.

Financial protection for loved ones

Pays a life insurance death benefit to loved ones if the unexpected were to happen.

Income protection

Replaces a portion of your income if you are unable to work due to a disability or illness.

Long term care protection

Learn about the long term care benefit.

Financial independence

Access to cash value that can help to supplement retirement income or other needs.1,2,3

All-around 360-degree protection

Feel more confident by preparing for the ‘what ifs’

If you’re in an accident or suffer from a serious illness, you could experience five common outcomes. SafeGuard360™ offers essential coverage, helping you navigate the challenges of life with confidence.

SafeGuard360™ can protect you from the five common outcomes:

If you fully recover from your illness or injury and can continue to work, your policy will continue to perform and accumulate cash value. Your policy’s cash value can help to supplement future retirement needs or other life’s expenses.

If your illness or injury prevents you from working full time, you’ll get a partial disability income benefit and you won’t have to pay your premiums.

If your illness or injury prevents you from working entirely, you’ll get the full disability income benefit and you won’t have to pay your premiums.

If your illness or injury leaves you unable to work and needing chronic care, you’ll get the full disability income benefit, you won’t have to pay your premiums, and you can access your long term care benefit.

Your designated beneficiaries will receive the guaranteed life insurance death benefit payment, which is income tax-free.6

FAQs about combination life insurance

Combination life insurance, also known as hybrid insurance, is an insurance policy that offers different coverage and features, in addition to life insurance, that can meet your diverse protection needs. The most common type of combination insurance is life insurance with long term care protection.

Guardian’s SafeGuard360™ takes holistic coverage a step further by pioneering a 3-in-1 solution that combines the benefits of life insurance, long term care, and disability income protection.

The main advantages of combination life insurance include streamlined processes and flexible benefits.

Traditionally, if you need coverage for whole life, disability, and long term care, you’d have to apply and go through underwriting (possibly medical exams) for each policy separately. With combination or hybrid life policies, you can secure multiple protection needs through just one application and underwriting process, making it easier and a more efficient process for you.

It all depends on your specific needs and financial goals. If you’re seeking comprehensive and holistic coverage that protects you on multiple fronts, combination life insurance might be worth considering. A financial professional can help guide you through the available options, helping you make an informed decision.

Take the next step

Fill out the form below to connect with a financial professional who can help you on the path toward lifelong financial wellness.

All fields are required unless marked optional.

1 Some whole life policies do not have cash values in the first two years of the policy and don’t pay a dividend until the policy’s third year. Talk to your financial representative and refer to your individual whole life policy illustration for more information.

2 Dividends are not guaranteed. They are declared annually by Guardian’s Board of Directors. The total dividend calculation includes mortality experience and expense management as well as investment results.

3 Policy benefits are reduced by any outstanding loan or loan interest and/or withdrawals. Dividends, if any, are affected by policy loans and loan interest. Withdrawals above the cost basis may result in taxable ordinary income. If the policy lapses, or is surrendered, any outstanding loans considered gain in the policy may be subject to ordinary income taxes. If the policy is a Modified Endowment Contract (MEC), loans are treated like withdrawals, but as gain first, subject to ordinary income taxes. If the policy owner is under 59 ½, any taxable withdrawal may also be subject to a 10% federal tax penalty.

4 2022 Insurance Barometer Study, LIMRA and Life Happens, 2022

5 The Faces and Facts of Disability, Social Security Administration, 2024

6 All whole life insurance policy guarantees are subject to the timely payment of all required premiums and the claims-paying ability of the issuing insurance company. Policy loans and withdrawals affect the guarantees by reducing the policy’s death benefit and cash values.

SafeGuard360TM is issued by The Guardian Life Insurance Company of America (Guardian®), New York, NY. This product combines: Guardian’s Whole Life Paid-Up at Age 99 policy (form ICC21-WL, 21-WL, or state equivalent ); the Disability Income and Waiver of Policy Premium Benefit Rider (form ICC21-DIR, DIR (12-2021), or state equivalent); and the Accelerated Death Benefit for Long-Term Care Services Rider (form ICC13-LTCR, 13-LTCR, or state equivalent) which is marketed as Guardian’s Long-Term Care Rider. Product provisions, features, and availability may vary by state. Exclusions and limitations may apply. Underwriting approval is required to purchase coverage, and a medical exam may be required. For costs and complete details of the coverage, call your agent or the company.