Guide to Disability Insurance for Physicians

Last updated March 20, 2025

What would your life be like if you couldn't treat patients – or earn income – for a year? A decade?

That possibility is not as remote as you might think: One in 5 working Americans have been out of work for an extended period during the past 10 years due to a condition, injury, or illness.1 Disability is a risk for every working person, but the stakes can be even higher for medical professionals. Their capacity to earn a substantial income often depends on the ability to perform highly specialized manual tasks; and younger practitioners are often saddled with levels of student debt that would be hard to repay with a “normal” salary.

That's why disability insurance companies like Guardian offer disability insurance that is specifically designed to help medical professionals protect their finances – and way of life – when a disability prevents them from earning an income. This article will help you better understand:

The different kinds of disability insurance and how they work

Many professionals underestimate the need for disability insurance because they associate it with the types of on-the-job accidents that might occur at a construction site or factory.

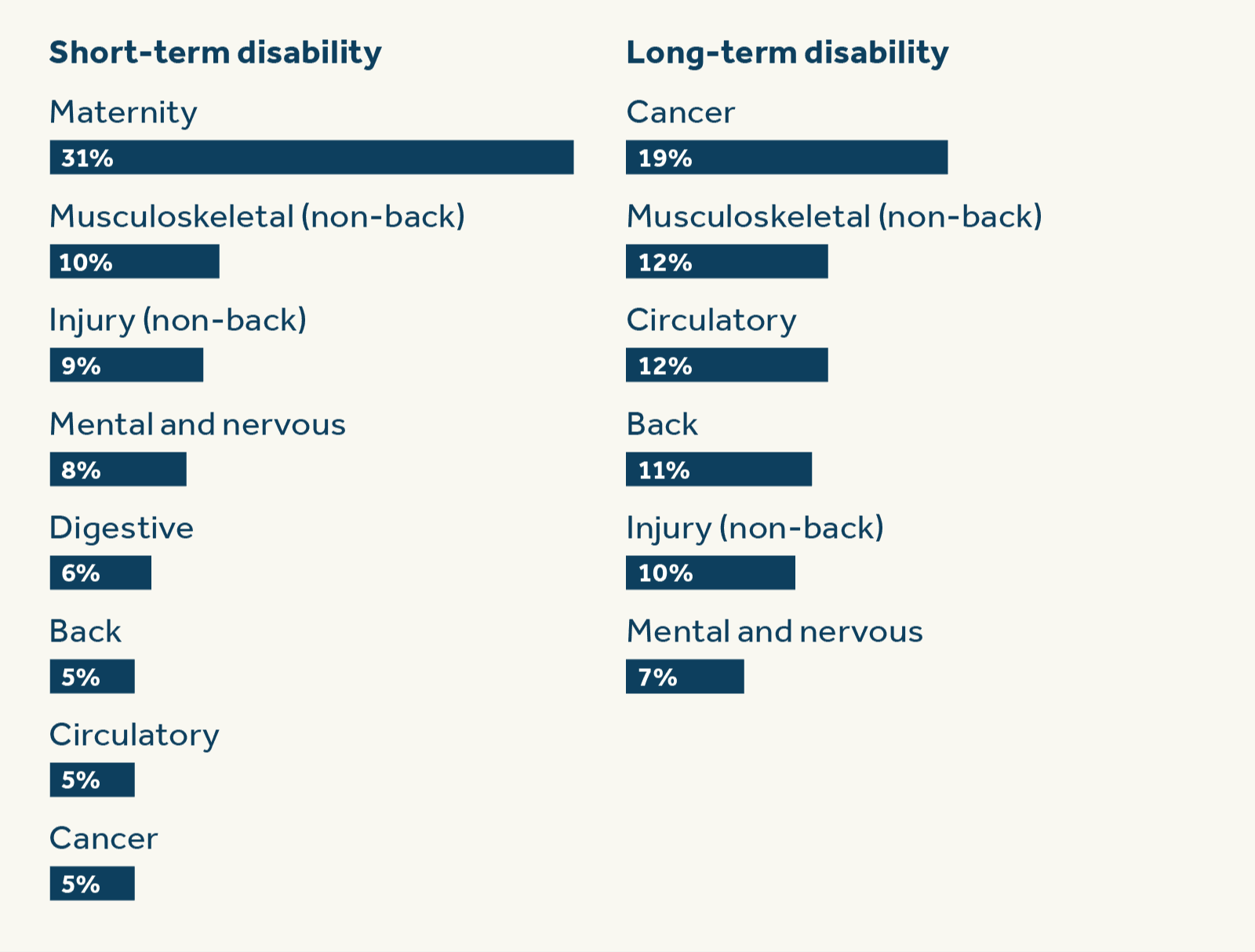

However, many types of disabilities are actually caused by disease. In fact, 44% of long-term disabilities are caused by illnesses such as cancer, Musculoskeletal conditions (non-back_ circulatory or heart disease, or back related issues.2

Leading Causes of Disability Claims 2

Disability insurance doesn't protect you from disease and accidents; it protects your ability to earn income, which is likely your most valuable asset. Sometimes called disability income insurance, this coverage replaces a portion of your income when you're too sick or injured to work. The benefits you receive can be used for anything you want or need, from mortgage, utility, and loan payments to groceries and childcare – or even vacations and entertainment.

Two types of disability policies: short term and long term

Short term disability insurance (or STD) is for temporary disabilities and is designed to replace up to 60%-80% of your income for a short period of time. STD is typically acquired as a group or workplace benefit, in part because it can be difficult to purchase as an individual. The typical benefit period is 3-6 months (and almost never more than a year), or until you can get back to work.

Long term disability insurance (or LTD), which is coverage for more severe or even permanent disabilities. It is often offered as a group benefit through health care practices and facilities or professional associations (such as the American Medical Association (AMA) or American Dental Association (ADA).

However, these plans tend to offer limited benefit amounts with few options, so many physicians get an individual policy for supplemental or standalone disability coverage. LTD benefits are designed to last much longer than short term disability payments, and benefit period length is an important consideration when applying for a policy. Standard choices include 2, 5, or 10 years; to age 65 and to age 67. A few disability insurance companies, including Guardian, offer coverage to age 70.

Every kind of disability insurance and policy should clearly define these items:

The benefit: The amount of disability income you get each month you are unable to work. In an individual long term disability insurance policy, the monthly benefit usually isn't taxed (unless paid for with pre-tax dollars);3 in a group STD plan paid for by your employer, the monthly benefit will most likely be taxable.

The benefit period: The total length of time you can receive benefits.

The waiting period: Also called an elimination period, it's the amount of time after becoming disabled until insurance companies pay benefits. For STD plans, the typical waiting period is 14 days – but it can range from 7 to 30 days. For LTD, 3 to 6 months is typical, but depending on the policy, it can be as little as 30 days or as long as a year.

The definition of disability: Every policy has a specific definition of disability insurance, stating what is needed to qualify for benefits (not to be confused with disability definitions and terms you should know). A long term disability policy further distinguishes between own-occupation disability (you qualify if you can't work in your specialty or field) and any-occupation disability (you only qualify if you can't do any work at all). A disability insurance for physicians policy should consider a true own-occupation definition of disability (see below).

Special provisions for medical professionals

Almost all disability income insurance policies have optional provisions, called riders, to tailor coverage to the policyholder's specific needs. A physician disability insurance disability insurance policy goes a step further, with a true own-occupation definition of disability tailored to the needs of dentists and physicians.

Why is this so important? Because when a medical professional loses the ability to practice his or her trade, it may be almost impossible to find a replacement career with a comparable salary. Each insurance company defines own-occupation for physicians differently, so take the time to make sure you understand what is covered before signing the dotted line.

To illustrate, here is how own-occupation coverage works in a disability insurance policy for physicians from Guardian:

A definition just for physicians

Our enhanced definition starts with our strong True Own-Occupation Definition of Total Disability. If totally disabled, it helps provide a physician with the flexibility to be gainfully employed, in some instances, even in their own practice, and still receive total disability benefits.

More ways to qualify for benefits*

Then, we add a straightforward, easy-to-understand formula to qualify for benefits. It's based on the source of your earnings and provides more ways to qualify for total disability benefits.

We'll consider you totally disabled if more than 50% of your income is from:

Hands-on patient care and, solely because of injury or illness, you can no longer perform hands-on patient care; or

Performing surgical procedures and, solely because of injury or illness, you can no longer perform surgical procedures.

If you don't qualify for benefits under the source-of-earnings formula above, then we'll look at your key duties, including those you were performing in your medical specialty at the time your disability began, to assess whether you qualify.

How it works

See how three different physicians qualify for total disability. The first two qualify using the enhanced formula, and the third under a traditional assessment of how the disability affected his or her ability to perform occupational duties.

Surgeon | |

|---|---|

Pre-Disability Sources of Income | 60% from surgery 40% from patient care and office visits |

Post-Disability Capabilities | Persistent tremor in dominant hand Cannot perform surgery Able to diagnose and treat patients |

Under Our Enhanced True Own-Occupation, Considered | Totally Disabled (full benefits) because more than 50% of income came from surgical procedure and he or she can no longer perform those due to disability |

Internist | |

|---|---|

Pre-Disability Sources of Income | 100% from hands-on patient care and office visits |

Post-Disability Capabilities | Spinal cord injury Cannot diagnose and treat patients |

Under Our Enhanced True Own-Occupation, Considered | Totally Disabled (full benefits): because more than 50% income came from patient care and he or she can no longer do that due to disability |

Pathologist | |

|---|---|

Pre-Disability Sources of Income | 100% from specimen evaluation |

Post-Disability Capabilities | Macular degeneration |

Under Our Enhanced True Own-Occupation, Considered | Totally Disabled (full benefits): While unable to qualify under the enhanced formula, he or she would qualify based on the inability to perform the material and substantial duties of his or own occupation (True Own-Occupation) due to disability |

Employment options while totally disabled

Each physician, while eligible for total disability benefits, can choose to be:

Gainfully employed full time or part time anywhere, even in his or her practice/business; or

Not gainfully employed and still receive his or her full total disability benefits.

Benefit amount

Most LTD policies won't let you qualify for more than 80% of your salary, but since an individual policy is typically paid for with after-tax dollars, the benefit isn't taxed, so 80% tends to be more the enough. However, if you're still in residency and expect to earn significantly more in the near future, some insurance companies may offer a higher disability coverage amount. In any case, you should consider opting for a rider that lets you increase your coverage in later years without having to provide additional evidence of good health. As an example, Guardian offers two such options:

Future Increase Option: This provides the opportunity to increase coverage annually through age 55. It's your choice whether or not to apply for additional insurance coverage.4

Benefit Purchase Option : This gives you the opportunity to increase coverage every three years until age 55, as long as you apply for and purchase at least half of any amount of additional coverage offered.5

Riders you should look for

Beyond the type of future purchase riders mentioned above, a disability insurance company should offer optional provisions to address the specific challenges faced by many medical professionals:

Student loan protection rider: Early career doctors have invested heavily in their education, and medical student loans don't just go away if you become disabled and can't earn an income.6 This optional benefit provides extra money to ensure student loans are paid during the benefit period.

Basic or enhanced partial disability benefit rider: These options protect you by paying a partial benefit if you suffer an injury or illness that limits your ability to perform certain types of care or procedures but doesn't cause total disability.

Retirement Protection: If you become totally disabled, there's a good chance you won't be able to make your regular retirement plan contributions. Even if you return to full activity in a year, those lost contributions – compounded – could have a large impact on your retirement nest egg years later. This rider helps protect retirement savings by replacing the contributions you would have made to your defined contribution plan while totally disabled.

In addition to those riders, here are some important options to consider when purchasing disability insurance for physicians – or any other long term disability policy:

Non-cancelable provision: This states that the insurer cannot raise your premiums as long as you keep paying them. Typically goes with a guaranteed renewability provision.

Guaranteed renewability: A provision which states that the insurance company will not cancel your policy or change the terms and features as long as you continue paying your premiums – but they can raise your premiums (unless the policy is also non-cancelable).

Waiver of premium: This means that premiums are waived while you are disabled and receiving benefits. Guardian goes a step further by offering a policy that waives premiums an extra six months after you recover and benefits end.

Cost-of-living adjustment (COLA): A rider that states the insurance company will increase your benefit to account for inflation.7

Lump-sum disability benefit: Provides a “bonus” benefit at age 60, equal to 35% of all the disability benefits paid until that age to make up for lost savings during a period of disability earlier in your career. This rider is only available through Guardian.

Catastrophic Disability Benefits: Provides extra funds – up to 100% income replacement – if you are functionally impaired or irrevocably disabled.

How to apply for disability insurance and what it costs

You can purchase disability insurance as an individual or as part of a group plan – but it's not necessarily an either/or choice. Many physicians with group coverage also have an individual policy, either to complement their short-term coverage or as a supplement to long-term workplace coverage.

Group disability insurance

Group disability insurance through a practice, employer, or association (such as the AMA or ADA) can be an excellent choice: Because the organization is buying for a large group of people, the premiums are typically lower than for an individual policy. In fact, many employers provide STD as a mandatory (employer-paid) or subsidized employee benefit.

Long term disability insurance is also available from many medical employers. However, there are a few drawbacks: The policies tend to offer basic benefits with few optional features. Since premiums are paid with pre-tax dollars, any benefits collected are subject to taxes. The plans typically aren't portable, so if you leave the practice or facility, you'll lose your coverage. Finally, the benefit amount isn't sufficient for many physicians, particularly those with larger incomes. So many doctors choose to buy individual coverage, either for standalone coverage or to supplement their group disability plan.

Individual disability insurance for physicians

When you choose to purchase a personal policy to protect your future there are far more options for tailoring coverage to your specific needs. You're not tied to a particular practice or employer, because individual coverage stays with you as long as you pay your premiums.

As these policies are almost always paid for with after-tax dollars, the benefit income they provide is usually tax-free. It's most often bought through a financial professional; if you don't have one, a Guardian financial professional can give you a disability insurance quote

Cost

A popular rule of thumb is to expect to pay between 1% to 4% of your annual salary for this type of coverage. Much of that variation is depends on the terms and provisions you choose for your policy, including:

The benefit amount: The more you receive for each month of disability, the higher the cost of the policy.

The waiting period: If you have enough savings or assets to tide you over, you can lower premiums by choosing a longer waiting period.

The benefit period: The shorter the benefit period, the lower the premiums; however, since most disabilities are resolved within 5 years, the cost differential between a 5-year benefit period and one that lasts through retirement may not be as high as you think.

The definition of disability: While not recommended for physicians, if you forego an own-occupation definition, your premiums will be lower.

Optional riders: While some riders may be included at no extra charge, others will add an incremental cost to your policy.

No matter what terms and provisions you choose, much of your actual policy cost will be determined on by the statistical risk you present to the insurance company. That risk will be analyzed and calculated during an underwriting process that takes into account a number of factors, including:

Medical specialty: Higher risk specialties are those that perform interventional procedures, such as surgeons, obstetricians, and emergency room doctors; by contrast, GPs and dentists tend to be classified as lower risk.

Age: To obtain the best rates, don't put off getting insurance coverage, particularly while you are healthy.

Health: Expect to answer questions about your family medical history, pre-existing conditions, tobacco and alcohol usage. There will also be a paramedical exam paid for by the insurer.

Finances: Since benefit amounts are calculated as a percentage of your earnings, the insurer will evaluate all your sources of earned and unearned income.

Location: As a rule, insurance regulations, living costs, and income vary by state; these are reflected in your policy costs.

Timing

The process of buying individual long term disability insurance usually takes about 4-6 weeks, in part because there's a lot for doctors to think about. When you discuss disability insurance with your financial professional, be prepared to share as much as you can about your financial situation and goals, so that they can tailor your disability policy to your needs. Be prepared to look at a few different policy variations, and consider getting quotes from a few different companies, because each assesses risk differently. But don't delay: your risk – and cost for disability insurance coverage – will only increase with time.

Frequently asked questions about disability insurance for physicians

Disability insurance replaces income if you become disabled and can't work. Every medical professional who relies on their income may want to consider disability insurance.

A popular rule of thumb is to expect to pay 1%-4% of your annual salary.

Doctors have complex needs, and their income depends on the ability to perform specialized tasks. The best disability insurance for physicians plans include a true own-occupation definition of disability, and they should work with a financial to tailor the other terms and provisions of the policy to their needs.

Disability insurance for residents may be a good idea. As long as you have a good idea of what your career path will be, residency is a great time for a doctor to get disability insurance for physicians because your rates will never be lower. However, make sure to get a policy with a future purchase rider that allows you to increase your coverage amount as earnings rise in later years.