Quantum Leap

This archived material is for informational purposes only; the information provided was accurate at the time of publication but may no longer be current.

This archived material is for informational purposes only; the information provided was accurate at the time of publication but may no longer be current.

The digital revolution continues to alter the landscape of human resources technology (HR tech). Increasingly, technology is receiving greater attention from C-suite executives seeking to address the growing complexity of HR and benefits administration. Interest is growing for platforms that integrate employee benefits applications with payroll, talent acquisition, and workforce management solutions.

The HR digital adoption curve continues to trend upward

The COVID-19 pandemic further accelerated employers’ use of technology to improve efficiency and accommodate the needs of an increasingly remote and hybrid workforce. Seven in ten organizations say the pandemic caused their leadership to make technology adoption a higher priority, and nearly half have expanded their use of benefits technology as a result.

7 in 10 employers say their senior leadership is more focused on benefits technology as a result of COVID-19

Half of all employers have increased their use of benefits technology since the start of the pandemic

Most employers continue to ramp up their investment in benefits-related technology, with eight in ten expecting further increases in the next three years to address their top benefits challenges, including: controlling costs, increasing efficiency, ensuring legal compliance, and improving workforce financial wellness.

Investment in HR technology soared at the height of the COVID-19 pandemic

The pandemic resulted in investors steering more than $12 billion into HR tech-related software and platforms in 2021. Much of the investment growth was in core HR and employee benefits functionality and integrated platforms for mid-size organizations (i.e., 100-1,000 employees).

Growth in HR technology venture capital1

2017 – 2021 in billions

2017 | $1.9 |

2018 | $3.2 |

2019 | $4.5 |

2020 | $3.4 |

2021 | $12.3 |

Today, eight in ten employers report that their HR and benefits processes are more digital than paper-based, and many have experienced efficiency gains and improved user experience. Despite the rapid migration from paper to digital benefits administration, some feel HR technology has yet to fully achieve their organization’s goals. Non-integrated systems, lack of industry standards, and dependence on electronic files and data transfer are cited among the primary obstacles.

API integrations are a quantum leap forward for HR and benefits technology

The emergence of real-time connectivity, made possible by application programming interfaces (APIs) between carriers and platform vendors, may prove to be an inflection point for benefits technology. As API solutions become more readily available in the marketplace, more employers will reap the rewards.

Complexity of managing benefits is driving technology investment

For many employers, COVID-19 has added further costs and complexity to benefits policies and processes. Even before the pandemic, managing benefits were challenging for many employers due to a confluence of market and environmental factors that were fueling HR benefits technology adoption.

An expanding array of benefit offerings that better address workforce needs but are difficult for existing systems to effectively administer

Increased voluntary/employee-paid benefits, which require more flexible billing and eligibility options, but lack insurance industry standards

Evolving state and local regulations that make it particularly difficult, especially for multi-state employers, to maintain compliance of their benefits programs without the use of software or a platform

The changing demographics of a more diverse and remote US workforce. Generation Z has entered the workforce, and they are digital and mobile technology natives with very different expectations of a workplace and employee benefits experience.

Given the rapid pace of change in the employee benefits industry during the past decade, it isn’t surprising that two in three employers say managing benefits has become increasingly complex, up from 47% in 2012. This figure has been trending steadily upward since the passage and implementation of the Affordable Care Act (ACA) provisions.

Managing benefits is increasingly complex

Percentage of employers who agree (top three on a ten-point scale)

2012 | 47% |

2015 | 52% |

2022 | 63% |

Employers most challenged with managing benefits complexity are twice as likely to digitize their benefits processes

Larger firms (with 1,000 or more employees), those in the high-tech and education sectors, and young start-ups (less than five years in business) are among the most likely to feel challenged in managing their benefits programs.

At the same time, employers also face pressure to reign in benefit costs, ensure legal compliance, and increase productivity while offering affordable benefits that help attract and retain talent. Many are increasing their investment in benefits technology to help address these objectives.

Top employee benefits objectives

Percentage rated highly important (top three on a ten-point scale)

| no | 2023 | % change vs. 2014 |

Provide affordable benefits | 86% | +11% |

Control benefits-related costs | 83% | -- |

Increase employee productivity | 83% | +28% |

Improve workers’ financial wellness | 81% | +31% |

Attract and retain talent | 81% | + 21% |

Nearly half of all employers have increased their spending on benefits-related technology in the past three years. In addition, 79% expect to increase their benefits technology budget in the next three years.

Spending on benefits technology

Percentage of employers who planned to increase or decrease spending in the next 3 years

Increase | no |

2019 | 52% |

2023 | 79% |

Decrease | no |

2019 | 5% |

2023 | 2% |

HR technology adoption reached new heights in 2023

Use of HR technology has increased significantly in the past decade. The emergence of cloud-based technology has made it feasible for more employers of all sizes to take advantage — often from new, third-party tech firms — HR and benefits administration platforms, and enrollment firms. More than 90% of employers use a technology system/platform to manage some aspect of their HR or benefits functions, up from 70% five years ago. More than half are centralizing those functions with a single platform to realize the advantages of systems integration.

Employer use of HR technology

Percentage using a system/software for a least one HR function

2017 | 70% |

2020 | 76% |

2023 | 98% |

Benefits administration is among the fastest-growing categories of HR tech

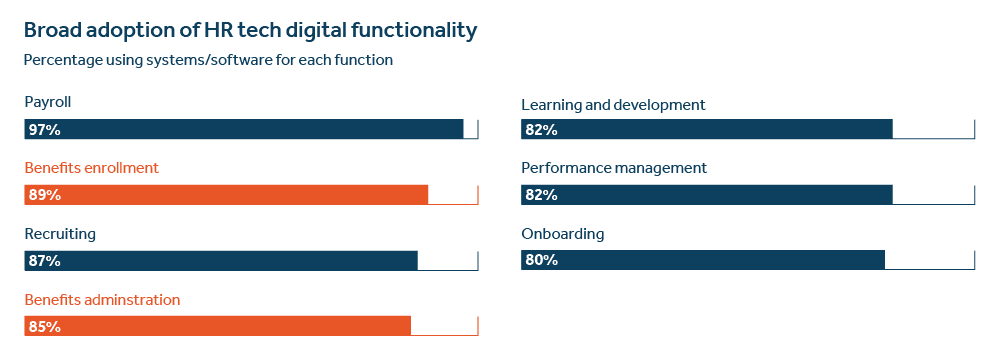

Use of technology for payroll processing is well-established (97% of organizations have digitized their payroll process), but more employers now use platforms for benefits administration and enrollment, as well as for recruiting and staffing.

Integration of HR and benefits technology is accelerating

As the role of the human resources function evolves to become a more strategic business partner, new and improved technology is replacing much of the administrative work that used to be part of the day-to-day HR activity. Payroll, recruiting, onboarding, and benefits administration have increasingly become digitized processes at many organizations.

Employers also are looking to integrate systems to better capitalize on the potential value of a comprehensive enterprise model. The percentage of employers placing greater importance on benefits digitization and integration of their HR systems has risen sharply since 2016.

Importance of digitization and integration

Percentage of employers who rated it ”highly important” (top three on a ten-point scale)

Increased system integration | no |

2023 | 68% |

2016 | 35% |

Increased benefits digitization | no |

2023 | 69% |

2016 | 37% |

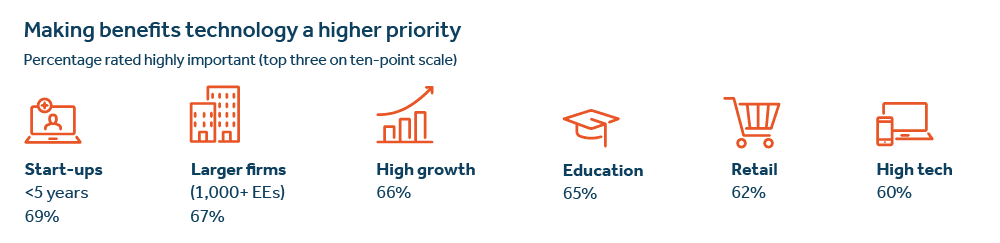

For some employers, digitization and systems integration already play a central role in their overall benefits strategy, especially among larger firms. Utilizing technology is also a key benefits strategy among firms that are start-ups, high-tech and growing fast, and those in retail and education.

Technology is now an integral part of benefits strategy for many employers

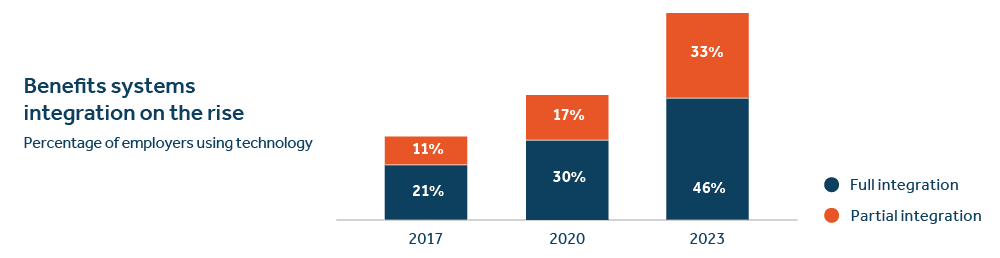

In 2023, more than half of employers surveyed reported that their core HR and benefits systems are at least partially integrated, up from about one-third in 2017. Yet larger employers often rely on a patchwork of siloed legacy systems, and many smaller firms still depend on paper and manual processes.

Payroll is the most common function to be integrated with other HR technology modules, while about 40% of employers use standalone platforms for benefits enrollment and administration.

Despite the rise in benefits technology as a strategic priority, many organizations have yet to realize the full potential of HR and benefits technology. These gaps underscore the significance of aligning an organization’s technology goals and needs with the most appropriate partners and solutions.

Gaps in meeting benefits technology objectives

Percentage rated highly important/highly successful

| no | Strategic importance | Success to date | Gap |

Increase digitization | 61% | 20% | -41 |

Increase systems integration | 62% | 18% | -44 |

Managing non-medical benefit plans can consume roughly one week per month

The ongoing administration of non-medical benefits plans (e.g., dental, disability, life, accident, critical illness, etc.) can be time-consuming, especially for those organizations with manual, non-digital processes. In 2023, employers surveyed said they spend an average of nearly four days a month on these activities (down slightly from 40 hours in 2019).

35 hours per month is the average time to manage tasks related to non-medical benefit plans

Many organizations struggle to efficiently administer the core elements of their non-medical benefits programs. Tasks such as processing employee eligibility records, evidence of insurability, and billing and payroll reconciliations are among the most time-intensive.

Hours per month on benefits administration

| no | Average |

Member enrollment/eligibility changes | 10 |

Evidence of insurability process | 7 |

Reconcile carrier bill with payroll deductions | 4 |

Manage the billing process | 4 |

Help employees resolve claims issues | 4 |

Help employees with leave reporting | 3 |

Update eligibility info on carrier websites | 3 |

Even after the initial enrollment and installation of a platform, the annual process can be time-consuming. Employers spend nearly one-fourth of a typical workweek updating plan information on their platform for their most recent renewal.

10 hours is the average time for updating platform information for recent renewal

The larger the employer, the more time they spend handling administrative tasks for their non-medical benefits. Large organizations spend almost double the average, or 64 hours, supporting the ongoing management of their non-medical benefits.

Hours spent managing non-medical benefits

Monthly average by employer size

Number of employees | Hours |

<50 | 32 |

50-99 | 36 |

100-999 | 45 |

1,000+ | 64 |

Predictably, employers that feel more challenged by the growing complexity of managing employee benefits programs spend more time than average with ongoing benefits administration tasks.

Hours per month on non-medical benefits tasks

By perceived level of complexity managing benefits

High complexity | 44 hours |

Medium complexity | 25 hours |

Low complexity | 15 hours |

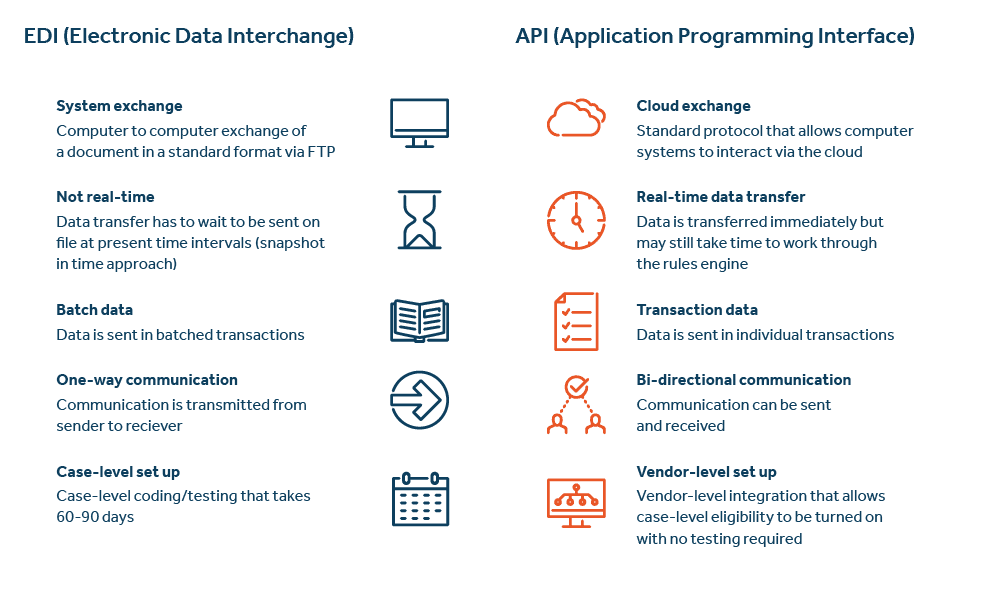

EDI is preferable to a paper process, but it has its drawbacks

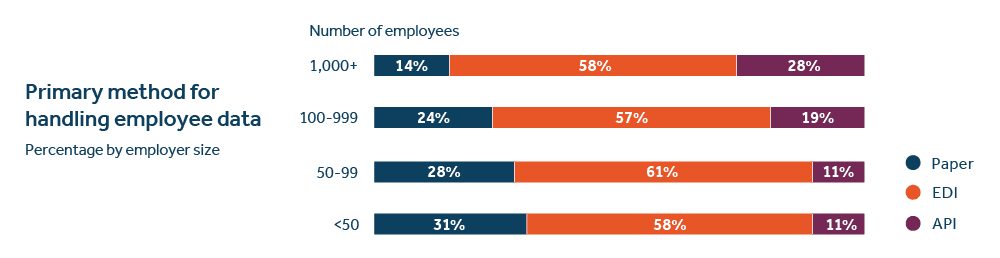

In the past two decades, the benefits industry has migrated from mostly paper-based processes to greater digitization. Today, electronic data interchange (EDI) is the most common approach to manage and sending enrollment/eligibility data to a benefits administration vendor.

Nearly six in ten employers manage benefits-related information using EDI — more than twice the share of those with paper processes.

Primary methods of handling employee data

Collecting enrollment/updating eligibility

EDI process | 58% |

Paper process | 22% |

API process | 20% |

Employer access to platforms offering application programming interface (API) integration (e.g., real-time connectivity) with insurance carriers remains limited but is growing. In 2023, 20% of employers report having access to platforms using APIs, up from 5% just four years ago.

Larger employers are more likely to use EDI for collecting enrollment and eligibility data, while smaller firms remain more dependent upon paper processes.

1 in 4 employers cite EDI errors as a common problem

While EDI has been an improvement over a strictly paper process, it has its limitations. In fact, 1 in 4 employers say EDI errors are a common problem, generally tying back to issues with initial plan set-up. Large employers (1,000 or more employees) are more likely than small firms (fewer than 50) to experience EDI data issues (40% vs. 26%).

Adding new benefits to a technology platform requires careful planning and preparation, yet it can still be a challenge. Six in ten employers indicate that they have experienced problems when installing new benefits on their platform.

Frequency of issues adding benefits to platform

Percentage of employers using a technology platform

Never | 4% |

Rarely | 37% |

Sometimes | 39% |

Often | 20% |

The most frequent issues reported during platform set-up are inaccurate payroll deductions and incorrect rules for member benefits eligibility.

Top issues when adding benefits to platform

Percentage of employers using a technology platform

Inaccurate payroll deductions | 41% |

Incorrect rules for benefits eligibility | 39% |

Incorrect premium rates | 30% |

Issues with EDI files | 28% |

Incorrect product details (e.g., guaranteed issue amount) | 21% |

API integrations overcome the challenges of EDI

Benefits technology has been advancing through the introduction of API real-time connectivity between insurance carriers and benefit administration platforms. This represents a significant upgrade in the way employee benefits are managed. The differences between API integrations and EDI are significant.

The following are specific examples of how APIs can help improve the benefits management experience:

Policy API automates the passing of plan details and rates from an insurance carrier’s system to an employer’s benefits administration vendor — reducing setup time and eliminating errors.

Member Benefits API (EDI replacement) allows real-time transmission of all member transactions from the platform to the insurance carrier, eliminating the need to build and test EDI files, or for weekly reconciliation.

Evidence of Insurability (EOI) API provides a seamless experience for employees to complete the questionnaire within the enrollment process and offers automatic status updates to the employee and HR team.

Provider Directory API provides employees with seamless access to the provider directories within the benefits enrollment experience.

Benefits enrollment is going digital...and mobile

In the past decade, employers’ use of technology to support enrollment has been on the rise. More than eight in ten employers report using an in-house system, software, or third-party platform for their benefits enrollment. The larger the organization, the more likely they are to use a platform.

Enrollment process going digital

Percentage of employers using an enrollment system/platform

<50 | 88% |

50-99 | 87% |

100-999 | 89% |

1,000+ | 97% |

Mid-size employers (100 – 1,000 employees) are the most likely to integrate their enrollment with another platform, such as a payroll system, rather than use a standalone enrollment platform.

When selecting and managing an enrollment platform, most employers source the platform through their benefits broker but work directly with the vendor to implement and manage the platform.

Selecting and managing platform vendor

Employer sources and manages vendor | 44% |

Broker sources; employer manages vendor | 18% |

Broker sources and manages vendor | 38% |

3 in 4 employers cite “improving the employee experience” as the top reason for implementing a new enrollment platform

Implementing a new platform generally entails employer involvement with set-up tasks, from gathering requirements to testing the system. On average, employers spend 66 hours on platform implementation. Naturally, the larger the employer, the more time they spend on these tasks.

Hours spent on implementation tasks

Averages for all employers

| no | Hours |

Eligibility file set-up/resolving issues | 18.1 |

Gathering system requirements | 17.1 |

Attending implementation calls | 16.9 |

Reviewing and testing the system | 13.7 |

Total hours | 65.8 |

Benefits enrollment has gone digital — and more mobile — than ever, with 68% of workers indicating their latest open enrollment was on a laptop/PC or mobile device.

Nearly 7 in 10 workers enrolled digitally in 2022

Laptop/PC: 51%

Mobile device: 17%

And with greater use of technology over the past few years, workers are more than twice as likely to say they had a better enrollment experience in 2022 than in 2019, or pre-pandemic (35% vs. 16%).

That’s not surprising given that workers prefer access to more digital tools and are interested in their employer using an enrollment platform that offers more tailored, guided decision support.

4 in 10 wish their employer-provided an online platform with decisionsupport tools to help guide their selection of benefits

9 in 10 employers have digitized at least some parts of their benefits enrollment process

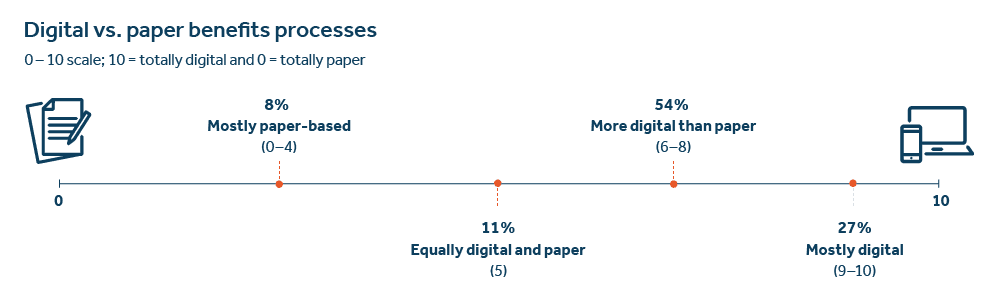

Digital benefits administration can save time and resources

Technology enables automation and smoother execution of tedious and often time-consuming benefit-related functions, e.g., tax reporting. Consequently, more employers are moving away from manual paper processes and migrating toward digitizing their core benefits processes.

Over 80% of employers indicate their benefits process is more digital than paper.

In 2023, more than eight in ten employers say their benefits admin processes are more digital than manual — up from 70% four years ago and 60% seven years ago. More than one in four indicate their process is mostly digital — a significant increase from pre-pandemic levels.

Highly digital organizations tend to be either very large corporations or small start-ups in the high-tech sector, many of whom manage benefits technology on their own.

Characteristics of highly digital employers

Start-ups (< 5 years) | 52% |

Larger firms (1,000+ EEs) | 49% |

Self-manage HR tech | 66% |

High tech sector | 41% |

Tech adoption is making it easier to manage non-medical benefits plans.

Given the surge in benefits technology adoption in the past few years, the number of hours employers are spending on these tasks for their non-medical benefits has declined slightly. But those that are now mostly digital in their processes are spending half as many hours on these activities compared to those employers that are still mostly paper-based.

Average hours spent per month on administering non-medical benefits

40 hours in 2019 | vs. | 35 hours in 2022 |

43 hours mostly paper-based | vs. | 20 hours mostly digital |

Organizations that have digitized most of their benefits administration process are less likely to feel that managing benefits is still too complex. These are typically larger companies; however, smaller firms are moving away from paper processes as cloud-based technology has made it more affordable. So, small businesses using technology are also feeling less burdened with managing their benefits programs.

Perceived benefits administration complexity

Percentage of employers by level of digitization

Mostly paper-based | 71% |

Paper and digital | 62% |

Mostly digital | 47% |

Digitization helps improve efficiency in managing benefits

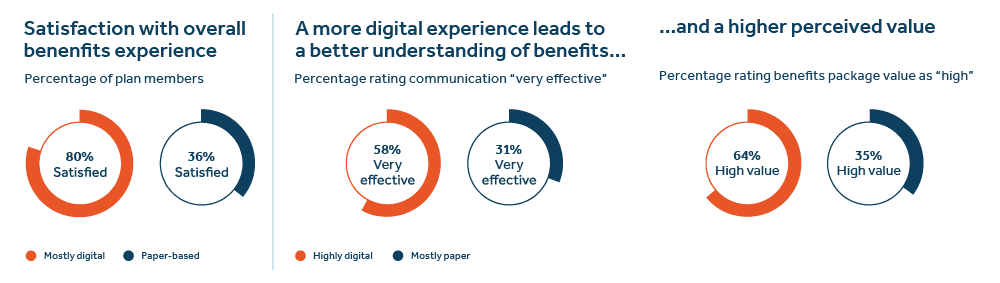

Naturally, a goal and expectation for many organizations is that digitizing their benefits processes will yield efficiency gains and improve the experience for workers when enrolling and using their benefits. Our latest research indicates that digitization is helping to achieve these goals.

Satisfaction with overall benefits experience

Percentage of benefits administrators

93% satisfied when using mostly digital

28% satisfied when paper-based

Digitization contributes to improved efficiency

Percentage of benefits administrators

80% highly efficient when using mostly digital

28% satisfied when paper-based

Employers that have migrated more of their benefits functions from paper to digital are in fact more satisfied overall with how their programs are running — these organizations report that increased digitization has helped them improve the user experience for their benefits teams, managers, supervisors, and employees.

The shift to digital benefits processes means greater efficiency for employers as it eases some of the burdens for open enrollment and managing benefits eligibility data. It can also mean quicker access to benefits and improved accuracy. Highly digital firms use technology more broadly across many HR-related functions and tend to report greater efficiency than those mostly reliant on paper

8 in 10 employers say digitization has led to greater administrative efficiency

The benefits processes from which employers are most likely to report efficiency gains via digitization include employee enrollment, record-keeping, and eligibility processing. Furthermore, organizations that have migrated most of their benefits functions from paper to digital indicate improved efficiency with new plan set-up, claims processing, and employee communication.

Digitization produces greater efficiency

Percentage rating each process highly efficient

| no | Mostly digital | Paper-based | Points difference |

Benefits enrollment | 67% | 44% | +23 |

Record keeping | 68% | 48% | +20 |

Eligibility processing | 53% | 33% | +20 |

New plan set-up | 47% | 30% | +17 |

Claims | 52% | 36% | +16 |

Employee communications | 39% | 27% | +12 |

Those employers that are mostly digital report spending nearly half as many hours each month on core benefits processes like eligibility changes, billing and bill reconciliation, and claims issues, compared to those that are still mainly paper-based.

Hours per month on benefits administration*

By employer level of digitization

| no | Mostly digital | Paper-based |

Member enrollment/eligibility changes | 4.5 | 9.1 |

Evidence of insurability process | 4.0 | 5.9 |

Reconcile carrier bill with payroll deductions | 3.0 | 6.3 |

Manage the billing process | 2.4 | 4.8 |

Help employees resolve claims issues | 2.2 | 7.3 |

Help employees with leave reporting | 1.9 | 4.5 |

Update eligibility info on carrier websites | 1.6 | 5.1 |

A digital experience contributes to more positive employee perceptions about the value of their benefits package

Employers that are more digital than paper-based in managing their benefits programs report higher levels of employee satisfaction with their benefits. In addition, workers who have a more digital experience when learning about, enrolling in, and using their benefits have more favorable attitudes toward the value of their employer’s benefits package.

Generation Z and younger millennial workers are particularly interested in a more digital and mobile benefits experience. Text and chat are also popular communication channels among younger workers for accessing and using their benefits.

Real-time connectivity can be a game changer

API integrations present an opportunity to dramatically improve benefits administration

In the last twenty years, the benefits industry has evolved from mostly paper processes to increased adoption of electronic data interchange. Today, the use of API technology remains low but is growing.

A shift in managing employee benefits data

In 2023, 20% of employers report that they have real-time data exchange for some aspect of their benefits administration (typically payroll or evidence of insurability). However, that figure is expected to increase significantly in the next few years as more platforms and carriers are partnering to establish API integrations for a wide range of processes, including benefits plan set-up, enrollment and eligibility transactions, and evidence of insurability processing.

1 in 5 employers are now making use of real-time connectivity in managing employee enrollment and eligibility updates

API connectivity is of greatest appeal among larger organizations as well as fast-growing start-ups, retail companies, and employers already highly digitized in their benefits administration.

Most likely to switch to carrier with API

Start-ups (< 5 years) | 59% |

Retail | 54% |

Mostly digital benefits | 51% |

Fast growth | 50% |

Employers with API integrations for plan member data rate their employee experience higher and with less administrative burden compared to those that are paper-based.

Those employers with API experience are enthusiastic about the potential for this technology to revolutionize benefits administration. They are more likely to be positive about the efficiency and employee satisfaction with their benefits administration and service compared to those without real-time connectivity.

1 in 3 employers would prefer to switch to a carrier for real-time connectivity

Assuming all else was equal, 34% of employers would recommend switching to a leading carrier for non-medical group benefits with real-time connectivity for member transactions (e.g., enrollment and eligibility updates) and plan updates (e.g., configuration, rates, renewal).

Employers with a keen interest in real-time connectivity tend to focus on benefits strategy, and especially on ways technology can enhance employee access to and use of their benefits.

Top benefits strategies

Percentage with high API interest vs. average

| no | All employers | High API interest |

Expand use of benefits tech | 47% | 69% |

Integrate more HR systems | 46% | 68% |

Improve employee communication | 45% | 61% |

Increase voluntary enrollment | 44% | 64% |

Integrate benefit offerings | 44% | 63% |

Outsource benefits administration | 35% | 54% |

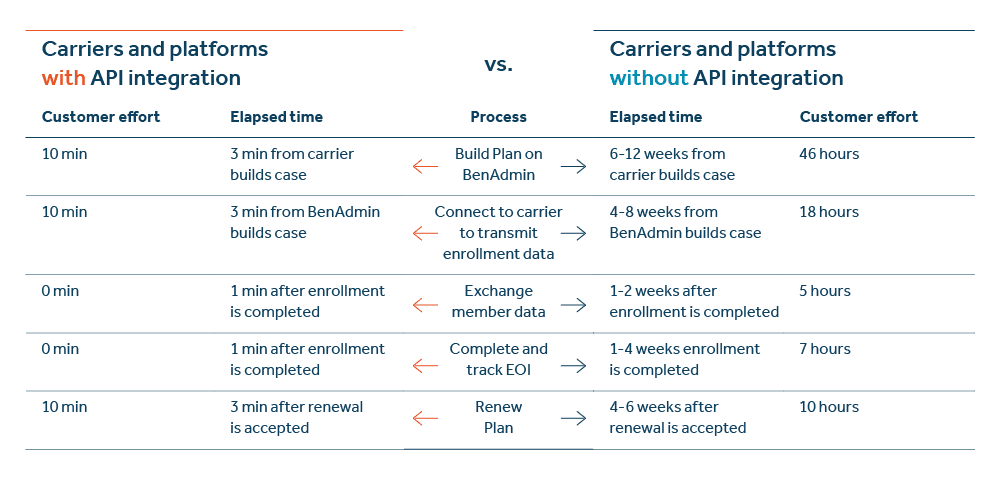

The market is ready for a quantum leap forward in benefits technology innovation

API technology is designed to make it easier for organizations to offer, manage, and access employee benefits by eliminating time-consuming, error-prone processes through real-time, seamless functions. Insurance carriers and third-party benefits administration platforms with integrated functions can dramatically improve the speed and quality of processes like initial benefits plan setup, collection of enrollment data, eligibility, billing, and plan renewal.

Real-time connectivity also enhances the employee experience when they interact with their benefits. The technology enables an easier provider lookup process and a simplified, integrated, and real-time evidence of insurability process that helps employees get access to the coverage they need without unnecessary delays.

Employers realize immediate and significant gains in efficiency, saving hundreds of hours in manual administration each year. This allows HR and benefits teams to focus on the more strategic initiatives of greater importance to their senior leadership teams.

Plan set-up can be reduced from an average of 46 hours over 6-12 weeks to just 10 minutes.

Exchanging plan member data goes from 5 total hours over 1-2 weeks to less than 1 minute.

And completion and tracking of evidence of insurability can be cut from 7 hours over 1-4 weeks down to less than 1 minute.

Time and Resources Saved with API Integrations (2023 Guardian internal analysis)

On core non-medical insurance plan administrative tasks

2 in 3 employers feel real-time connectivity is an important consideration when evaluating HR/benefits technology solutions

Employers need help navigating the HR technology landscape

The rapid evolution of benefits technology offers employers a wider range of options, but it can also create confusion about which solutions and vendors are the best fit for an organization’s specific goals and requirements.

1 in 3 employers say developing a benefits technology strategy is a major challenge.

Consequently, 35% of employers feel that creating a benefits technology strategy has been a significant challenge for their organization. And just one in four believe they have a well-developed benefits technology strategy. Most employers look first to their benefits broker for help with developing a technology strategy and to assess their platform options. Yet nearly two in five employers indicate they have not discussed benefits technology solutions with a broker in the past year.

2 in 5 employers have spoken with a broker about benefits technology in the past year.

Organizations most likely to rely on a broker to help source and manage their most recent technology platform installation are small to mid-size firms that are still mostly dependent upon paper processes and feel managing benefits is increasingly complex.

Employers more likely to use a broker for sourcing benefits technology platform

Mostly paper processes | 63% |

50-99 employees | 58% |

Managing benefits is more complex | 57% |

Increasingly, employers are working directly with third-party technology vendors to establish a new, or re-evaluate an existing, benefits technology strategy (37% in 2022, up from 29% in 2020).