Life insurance enrollment opportunity

Should something happen to you, life insurance helps provide financial support to the beneficiaries you choose — either people or causes. There is strength in knowing that who and what you love are protected. Life insurance can help surviving loved ones by replacing lost income to cover essentials such as rent or mortgage payments, college tuition, and funeral costs. Purchasing life insurance through your workplace is a great way to boost your financial confidence knowing your prepared for whatever comes your way. And, getting life insurance through your workplace benefits is typically an easier, less expensive, and more convenient way to get the coverage you want than if you were to purchase it on your own.

Life insurance for financial health

Why enroll now?

If you haven’t thought about your life insurance needs in a while, now is a great time to make sure that you have the right level of protection in place. If you already have some life insurance, it's important to ensure you have the amount that's right for you and those who depend on you. Review your workplace life insurance options and consider enrolling for the amount that best fits your needs.

Your employer provides you the option to elect term life insurance which provides protection for a specific period of time and the benefits are paid to your chosen beneficiary should something happen to you. For a limited time, you have an opportunity to enroll for a specific amount of term life insurance coverage with no health questions.1 See your plan summary for details.

Key benefits include:

Cost-effective rates exclusively offered to employer groups like yours

Convenience of payroll deductions

Ability to take the coverage with you if you change jobs or retire

Over 40% of families would face financial hardship within six months if the primary wage earner died — and 1 in 5 would start to suffer financially within one month.²

Why you're never too young to start planning ahead

Single adult starting out

If you pass away and don't have life insurance, final expenses and other costs could be a burden on those around you. For example, the average cost of a funeral is $7,000 to $10,000.3 And if anyone, like a parent, has co-signed for loans or other types of debt you have — including some student loans — that person could be responsible for the debt, or related taxes.4

Working parent

You should consider a death benefit large enough to help replace your income and cover family expenses for a given amount of time, usually until your kids are out of the house or your mortgage is paid off, but it could be longer.

Stay-at-home parent with a young family

When a parent chooses to care for children full-time rather than pursue a career, they have life insurance needs, because their labor has economic value. If a stay-at-home parent were to pass away unexpectedly, how would their spouse pay for childcare or other services that a single working parent might rely on to help keep the household running? Life insurance can help.

Homeowner

If you have a mortgage on your house and something should happen to you, life insurance can help to ensure that your family can continue to live their lives in the place they call home.

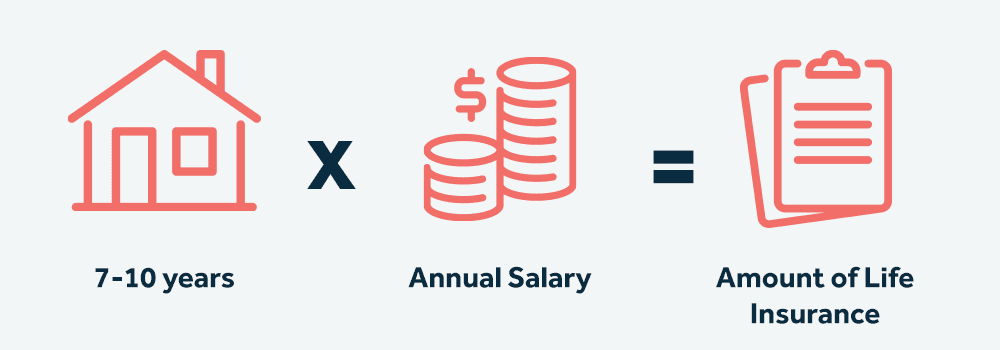

How much life insurance protection do you need?

As your life changes, so does the amount of life insurance you need. Getting married, growing your family, or getting a new job are all good times to review your life insurance needs. A general guideline is to have a policy equal to seven to ten times your annual salary.5

That might sound like a lot, but actually it can take years for a family to financially recover from the loss of a loved one.6 Even if you already have some life insurance, are you sure that it still meets your financial needs?

Frequently asked questions

Yes, you can take the coverage with you if you change jobs or retire. You will pay the premium yourself, typically on a monthly or annual basis, and it will be different than the group rate.

Purchasing life insurance through work is often less cost-effective because of the buying power of a group. What’s more, the process can be easier, especially if the coverage your employer is offering does not require health questions or medical exam and premiums are paid through convenient and automatic payroll deductions.

During this special enrollment period you can get a specific amount of term life insurance coverage without answering any health questions.

Your beneficiary, or beneficiaries, receive the death benefit when you pass away, and if you name more than one, they’ll split the death benefit payment between them according to the percentage indicated by you. Typically, the spouse or children of the covered person are named as beneficiaries, but those aren’t your only options. You can also name a charity, a trust, your estate, or another person close to you as a beneficiary. Parents should know minor children are not eligible to receive the death benefit, so if you have young children, you may want to consider setting up a trust to manage the payment for them until they’re of age.

Act now: Enroll for life insurance through your workplace

Your workplace benefits are here to help you protect your mind, body, and wallet®. Taking advantage of your benefits at work can be a smart and affordable way to get the financial protection you want for yourself and your family. Review the benefits offered through your workplace and determine how much life insurance is available to you. Your employer may provide life insurance as a benefit and you may opt to pay for additional life insurance through payroll deductions. Now is a good time to review your benefit options and enroll for the coverage that best fits you and your family’s needs.

1 If you do not enroll for life insurance coverage at this time, you may be required to provide a Statement of Health in order to apply for future coverage.

2 Life Insurance Awareness Month, LIMRA, September 2022.

3 Funeral Costs: How Much Does an Average Funeral Cost?, Parting, September 13, 2022.

4 Does a person's debt go away when they die?, Consumer Financial Protection Bureau, August 2, 2023.

5 This is Guardian's Rule of Thumb based on experience and may not apply universally to every individual and their unique set of circumstances.

6 Guardian's 12th Annual Workplace Benefits Study, Prepared and Protected, 2023.

Individuals who have previously withdrawn from completing Evidence of Insurability, have been declined for coverage due to completing Evidence of Insurability, or are considered a late entrant may not be eligible for this offer. Other limitations may prohibit the amount of coverage that you qualify for.

Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation.

Guardian’s Group Term Life Insurance is underwritten and issued by The Guardian Life Insurance Company of America, New York, NY. Products are not available in all states. Policy limitations and exclusions apply. Optional riders and/or features may incur additional costs. Generic Policy Form # GP-1-LIFE-15. The state approved form is the governing document. For NY, the Policy Form # is GP-1-LIFE-12-NY.