Mind, Body, and Wallet® 2025

Financial confidence — the first step toward overall well-being

When it comes to your well-being, you probably think about physical and emotional wellness. But financial health is the underpinning of well-being. We asked people what it means to be well. Across generations, occupations, and income levels, Americans define well-being in terms of mental and physical wellness. But it’s their financial wellness that they are most stressed about.

Get more insights to power your well-being.

Subscribe to our newsletter to fuel your mind, body, and wallet® with actionable insights and the latest research.

Forty percent of adults in the US say they’ve experienced increased anxiety and depression in the past two years.

Only about 1/3 of Americans rate themselves as "excellent/very good" when it comes to exercise and eating healthy.

Only 32% say they’re good about setting up and sticking to a long-term financial plan.

Just 44% of Americans are very satisfied with their life, the lowest level in a quarter century.¹

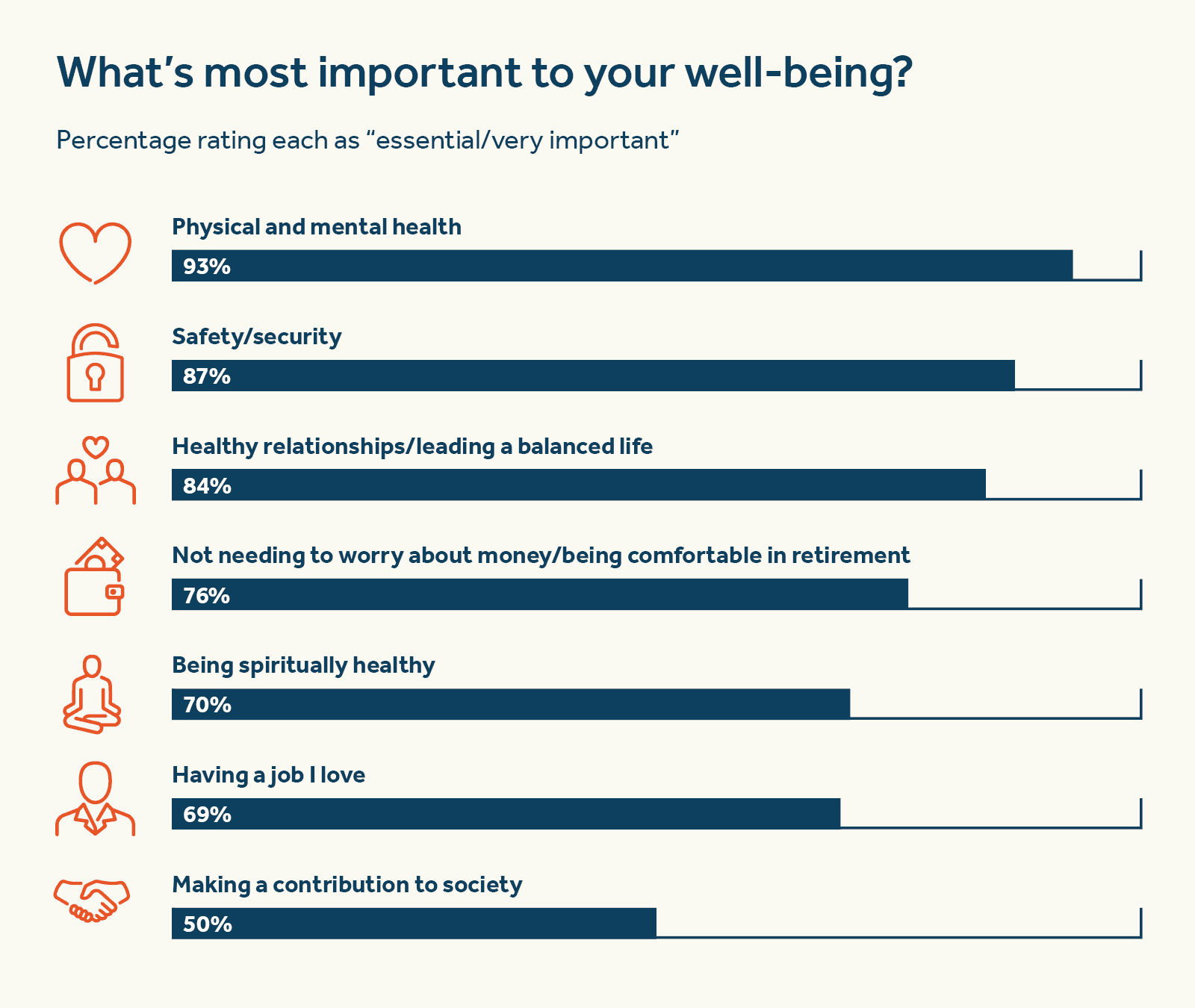

What’s most important to your well-being?

It’s clear that much of the anxiety people are feeling is related to money and their financial wellness. In fact, the top four stressors Americans face are related to their finances. Financial issues increase stress, and financial stress can lead to worse physical and mental health outcomes — having a major impact on overall well-being. But since the connection between financial wellness and well-being isn’t always clear, people don’t always prioritize their financial wellness.

Here’s the list of how Americans rate what’s “essential/very important” for their well-being.

How financial wellness shapes your mental, physical, and emotional health

Financial wellness plays a crucial role in mental health. When individuals are doing well with their financial health, they may experience less financial anxiety and overall psychological distress. This stability allows them to focus on other important aspects of their overall health, such as maintaining relationships, pursuing career goals, and focusing on their personal growth.

On the other hand, financial difficulties can lead to chronic stress, depression, and other intense emotional responses, which can negatively impact one's mental health and overall quality of life. Though everyone's financial goals will differ, prioritizing financial wellness in some capacity seems to provide a foundation that's essential for achieving balanced overall health.

Get more insights to power your well-being.

Subscribe to our newsletter to fuel your mind, body, and wallet® with actionable insights and the latest research.

Most Americans aren’t good at financial planning, leading to stress about money

As the underpinning of well-being, financial health is a strong factor in being able to achieve goals that help contribute to positive mental health and physical health, such as taking care of yourself physically and owning your own home. But since the connection between financial wellness and well-being isn’t always clear, people don’t always prioritize achieving financial wellness. This struggle is even more pronounced for women, who rate themselves significantly less well than men when it comes to their financial stability.

43% of women say they’re struggling with their financial health.

We found that Baby Boomers are the generation with the highest financial wellness (36% report high financial health) and older Gen X adults are the least (only 25% report high financial health). This is likely because retirement is on the horizon, and they don’t feel prepared for their post-work financial situation. Indeed, nearly 4 in 10 (38%) adults say they have regrets about their financial planning for retirement so far. Primarily, those regrets center around the financial reality of not having sufficient resources for paying bills and maintaining their quality of life.

Only 32% say they’re good at setting up and sticking to a long-term financial plan.

The inconsistency of Americans sticking to long-term financial planning highlights the importance of financial wellness as a key component of overall well-being. Without a properly managed financial situation, many individuals struggle to address other areas of their life that contribute to their overall happiness and health.

As Americans work to overcome challenges of what a new retirement looks like, the great wealth transfer is also under way. With $124 trillion set to change hands among family members by 2048, Americans need financial education to learn how to put that money to work for them long term. By enhancing their financial planning strategies, individuals can better prepare for retirement, manage their resources, and achieve a state of financial wellness that supports their broader life goals.

46%

Having a source of guaranteed household income in retirement.

44%

Having mental distress over my retirement savings last as long as I need it to.

43%

Being able to count on receiving my full Social Security benefit in retirement.

When you’re financially well, things like loving your job, making a difference, and spiritual health can play a more important part in well-being

When your financial challenges are managed, loving your job, making a difference, and spiritual health can play a more important part in well-being. Beyond the essentials that are foundational to well-being — health, safety, and enough money to live comfortably — are other key components of wellness that are tied to achieving higher levels of happiness and satisfaction in life. These things can deeply enrich well-being by inspiring joy and fulfillment in your life. For example, 85% of Americans rank strong relationships with loved ones as important to well-being and knowing that family members are healthy and happy is highly important to 81%. But these “extras” are hard to focus on if your financial concerns are front and center.

Loving your job and feeling that you’re contributing to society are other factors that can create a more meaningful life. They rank highest for high earners and those with strong financial health. That’s not surprising, given that less financial strain provides the type of comfort that can allow for people to contribute more to charity or focus on finding a job that inspires them if they don’t have to worry about spending habits and monthly bills. Seventy-three percent of adults in the US with high financial health say having a job they love is important.

Americans with high financial health are 20% more likely to say that contributing to society is important than those with low financial health.

The habits associated with achieving financial wellness

Most people just want enough money to live healthy, happy, balanced lives. It’s not about being rich. That suggests the key to better financial wellness — and higher overall well-being — is about better personal finance habits, not just more money.

Here’s what people who rate their financial wellness highly do:

They set up a long-term financial plan and they stick to it. Strategic financial decisions play a major role in how confident and prepared individuals feel for their future — and the more comprehensive it is, the better. Take time to lay out specific goals to manage money during each stage of life. Consider the role of life insurance and account for the cost of health care in retirement. Update your plan as your priorities and situations evolve.

61% of those who say they’re good at setting up long-term financial planning report having high financial wellness compared to 13% who report low financial health.

They work with financial professionals. When individuals work with financial professionals, they are 44% more likely to say they're on track to meet their financial goals. Financial professionals can help reach your goals, provide you reassurance when markets are volatile, and they can even help you find balance to focus on what's important to you.

69% of those who work with financial professionals report having high financial wellness.

Protect their financial future with products like life and disability insurance. Preparing for the future means putting yourself in the best position to handle whatever life throws your way. Life and disability insurance are built to protect you and your family financially, and they help to reduce financial stress.

Those who own life insurance and disability insurance are more likely to report having high financial wellness.

Reduce financial anxiety by having a plan for retirement income. Individuals with high financial wellness understand that building wealth for retirement is a marathon, not a sprint. Thinking long term not only helps train your habits toward delayed gratification, but it can also help mitigate financial problems when the stock market tumbles and surges.

86% of Americans who have a retirement savings plan report having high financial wellness.

Explore the full Mind, Body, and Wallet® 2025 report

Dive deep into Guardian's 14th Annual Workplace Benefits Study and uncover the intricate connections between mental health, physical health, and financial wellness.

Listen to the Mind, Body, and Wallet® podcast

What’s your well? We invite you to explore the evolving landscape of holistic well-being with us.

1 New Low in U.S. 'Very Satisfied' With Personal Life, Gallup, 2025

Unless otherwise noted, all stats are sourced from The Guardian Life Insurance Company of America, “Mind, Body, and Wallet® 2025: Financial confidence — the first step toward overall well-being,” 2025.

Material discussed is meant for general informational purposes only and is not to be construed as tax, legal, medical, or financial advice.