Why offer hospital indemnity insurance as part of your benefits plan?

Help provide financial support for employees and their families in times of medical need.

Last updated January 29, 2026

People who are hospitalized often face many unplanned expenses and risk financial shortfalls when they are unable to work. Hospital indemnity insurance is designed to help. There’s a good reason why supplemental health insurance plans, like hospital indemnity coverage, are among the fastest-growing and most sought-after employee benefits:* While medical insurance can cover expenses from a hospital stay, hospital indemnity insurance can help add another layer of financial well-being for employees and their families.

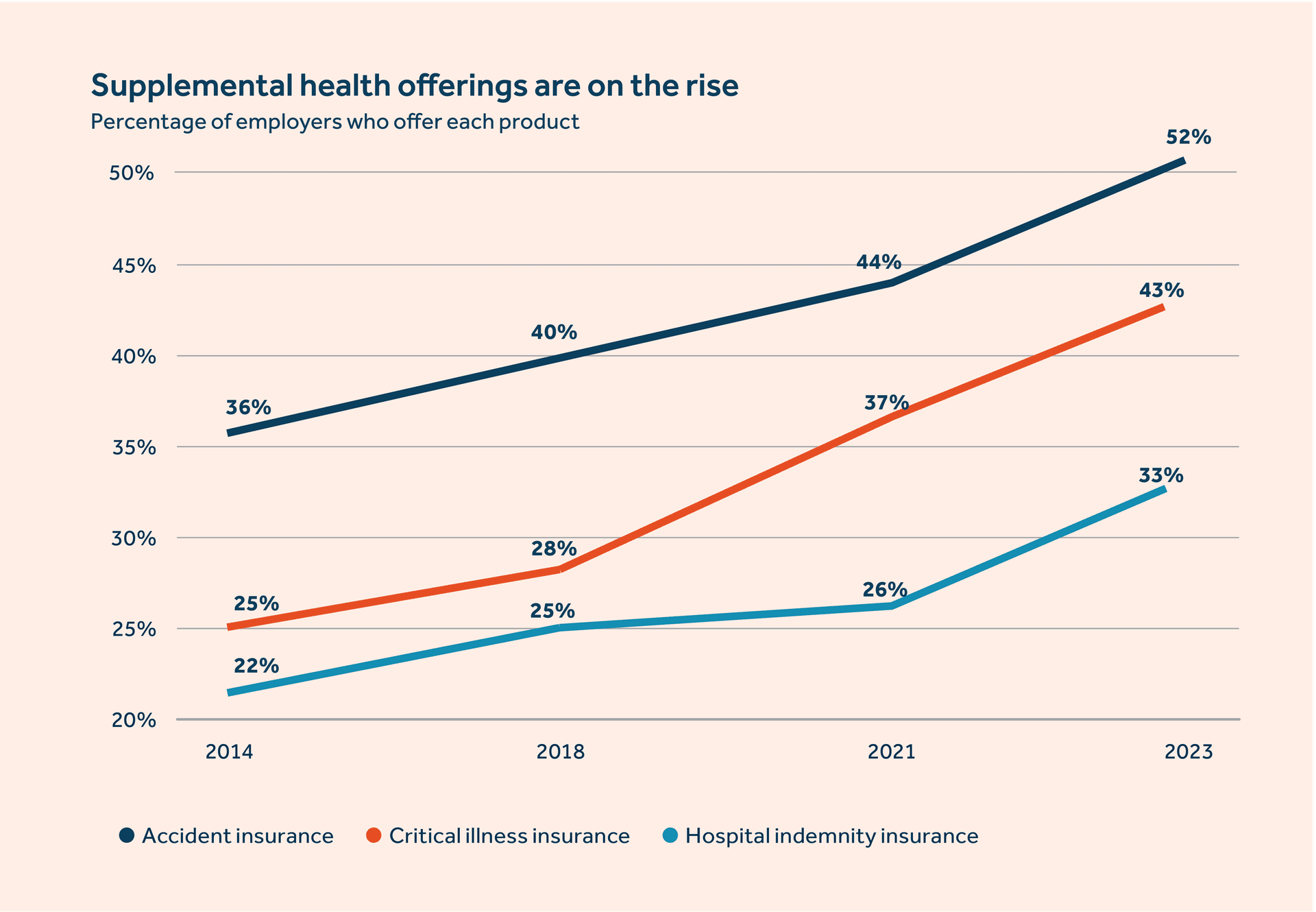

As of 2023, 33% of employers offered supplemental hospital indemnity insurance plans1

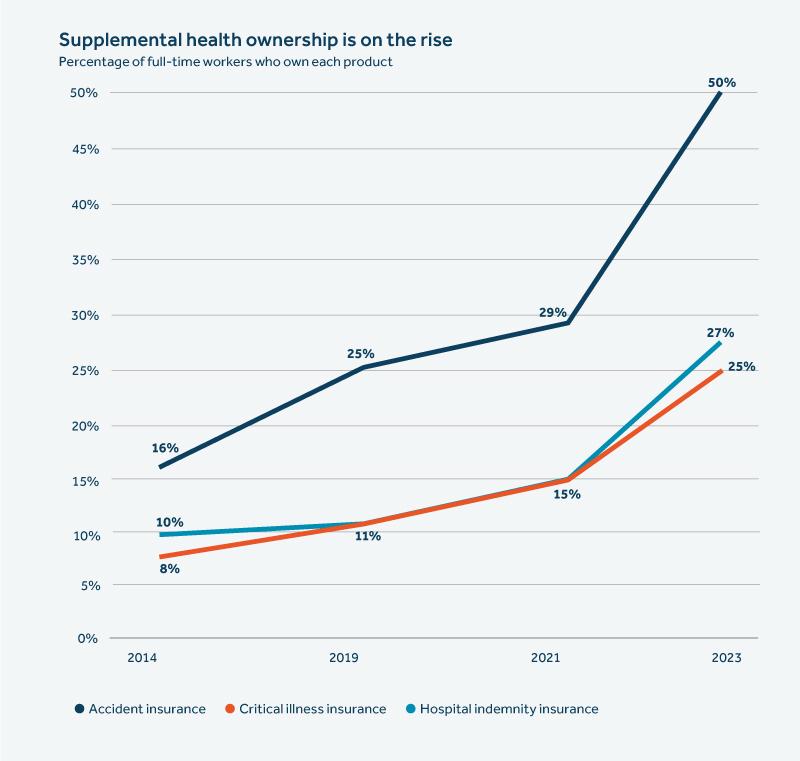

A growing number of employees are taking advantage of this protection.2

As of 2023, 33% of employers offered supplemental hospital indemnity insurance — up from 22% in 2014.3 And by that point, 27% of full-time employees owned a supplemental hospital indemnity plan — up from just 10% in 2014.4 In fact, hospital indemnity insurance is projected to be one of the top three growth products for 2022-2025,5 second only to critical illness insurance. Is hospital indemnity insurance worth it? A growing number of employees clearly think so.

When you consider these statistics — along with nearly 7 in 10 employers agreeing that supplemental health benefits help them meet workers' need for greater financial well being5 — you realize why supplemental health insurance can be such a powerful recruitment and retention tool.

Financial protection that’s needed now

The average cost of a three-day hospital stay is $30,000.6 What's more, medical bills and medical debt are the number one cause of personal bankruptcy in the United States.7 And — due to lack of financial confidence around covering out-of-pocket medical expenses associated with high-deductible health plans — many Americans skimp on care to lower health care costs.8

Hospital indemnity insurance can help add a layer of financial protection your employees need, because benefits are paid directly to the employee. That can help workers stay focused on their health, rather than stressing over bills. Hospital indemnity insurance can also help in several other ways:

Financial wellness

The insured person receives a lump sum benefit payment — sent directly to them and not a provider — which may help cover costs associated with a hospitalization, such as deductibles, co-pays, and other expenses not fully covered by their health insurance.

Because the lump sum benefit is paid directly to the insured person, they can use the funds in any way they choose, such as for extra costs like transportation, lodging, and other living expenses that may arise.

Confidence

It offers an additional source of financial well-being against the high costs of an unexpected hospitalization, which can average $10,000 per day.6

Having this coverage can help an employee focus on recovery rather than worrying about extra expenses.

It can help employees avoid the need to take on burdensome medical debt.

In essence, medical insurance insures medical expenses while hospitalized, but other costs can add up like extra childcare, transportation, help around the house, and pet care. Hospital Indemnity coverage pays lump sum benefits based on admission and days hospitalized that can be used to help any costs.

How hospital indemnity insurance improves employee financial wellness

Let’s take a look at an example of hospital indemnity in action. Meet Carol.9

Carol goes to the in-network ER and is admitted for emergency surgery. She has health insurance that pays for all of the medical expenses associated with her surgery.

Fortunately, Carol had taken advantage of an opportunity to buy hospital indemnity insurance through work. As a result, the following lump sum benefit was paid directly to Carol:

In-patient surgery benefit: $2,000

Hospital admission: $1,000

Diagnostic exam (CT): $250

Carol’s hospital indemnity benefit paid her a total of $3,250 after her emergency surgery.

Learn more about different types of supplemental health benefits.

Frequently asked questions about hospital indemnity insurance

Hospital indemnity insurance is almost always offered as a voluntary employee-paid benefit typically at no direct cost to the employer. If employees want this protection, they benefit from favorable group rates and the cost is often automatically deducted from their paycheck — and if an employee doesn’t feel it’s needed, they just won’t sign up. That means there may be very little downside to offering this benefit, other than the fact that it adds an extra bit of administrative work for the HR/benefits team. Also, to help ensure workers understand and take advantage of this protection, employers should commit to providing adequate education about how their plan works — but your benefits broker or provider should be able to provide those materials.

Hospital indemnity insurance provides financial support during an employee’s hospital stay. Hospital indemnity insurance sends a lump sum benefit payment directly to the insured — not to their medical provider — typically a specified amount for each day of hospitalization. This benefit can then be used by the insured for any purpose, including:

Deductibles

Co-payments

Transportation

Other related expenses

Typically, hospital indemnity insurance is a guaranteed issue, meaning that the employee can’t be turned down based on their medical history, and no medical underwriting is required. Providing financial support for periods of hospitalization” and “Medical insurance insures medical expenses while hospitalized, but other costs can add up like extra childcare, transportation, help around the house, and pet care. Hospital Indemnity coverage pays lump sum benefits based on admission and days hospitalized that can be used to help any costs.

Generally speaking, the answer is yes, assuming the mother delivers in a hospital (as opposed to opting for a home birth). Depending on the specific plan, hospital indemnity insurance is a benefit that helps pay for costs incurred with a hospital stay in conjunction with medical insurance. This makes it seem like medical insurance isn't needed, such as The mother’s hospital/ICU admission

Typically, up to 15 days of hospital confinement (for example, to care for a baby in a neonatal ICU)

Complications of pregnancy (to the same extent as other sicknesses covered by the plan)