Risk Redirect: Using group accident and disability insurance to reduce illegitimate workers’ compensation claims

This archived material is for informational purposes only; the information provided was accurate at the time of publication but may no longer be current.

This archived material is for informational purposes only; the information provided was accurate at the time of publication but may no longer be current.

Guardian’s report from the 7th Annual Workplace Benefits Study explains a way of using accident and disability insurance to help employers in managing risk and lowering costs associated with workers’ compensation claims.

Despite the downward trend in overall workers’ comp claim frequency, questionable claims are on the rise among certain workforce segments. Specifically, workers in high-deductible health plans (HDHPs) are more likely to report off-the-job injuries as workers’ compensation claims in order to avoid out-of-pocket costs and receive wage replacement benefits.

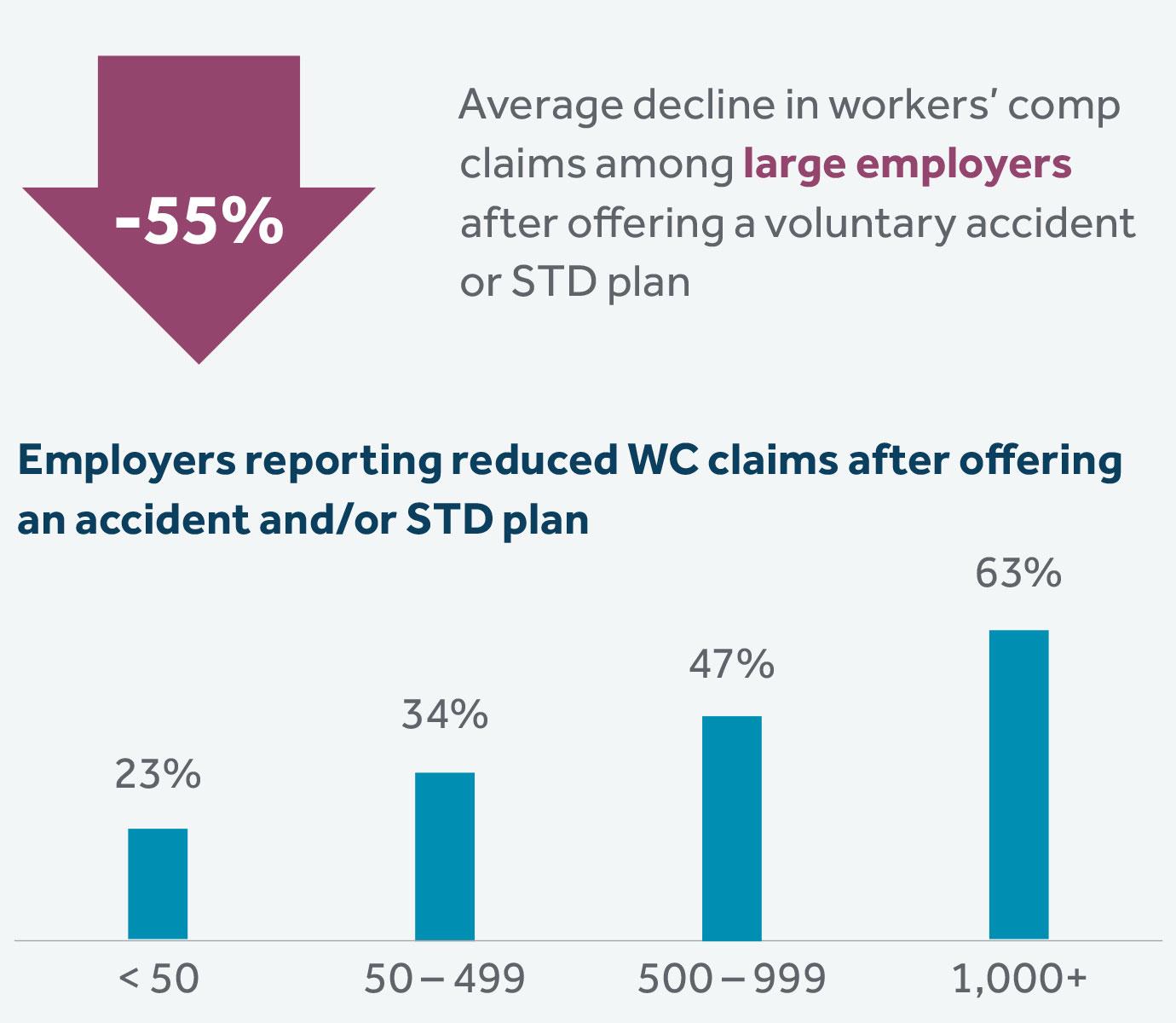

Employers who offered group accident and/or disability plans to their workforce to help pay for expenses not covered by their benefits programs reported a decline in overall workers comp claims.

The right insurance impacts the way workers file claims