Benefits Optimization 2023

This archived material is for informational purposes only; the information provided was accurate at the time of publication but may no longer be current.

This archived material is for informational purposes only; the information provided was accurate at the time of publication but may no longer be current.

12th Annual Guardian Workplace Benefits Study

Over the past few years, working Americans have experienced one of the most challenging periods in recent memory with global and domestic events having an impact on employee well-being. In fact, two-thirds (66%) of Americans say their financial well-being is worse off than a year ago.1 As a result, many Americans skimp on care to lower expenses, even if they own health insurance.

The need for benefits that help protect employee well-being — both financial and physical wellness — is more important than ever.

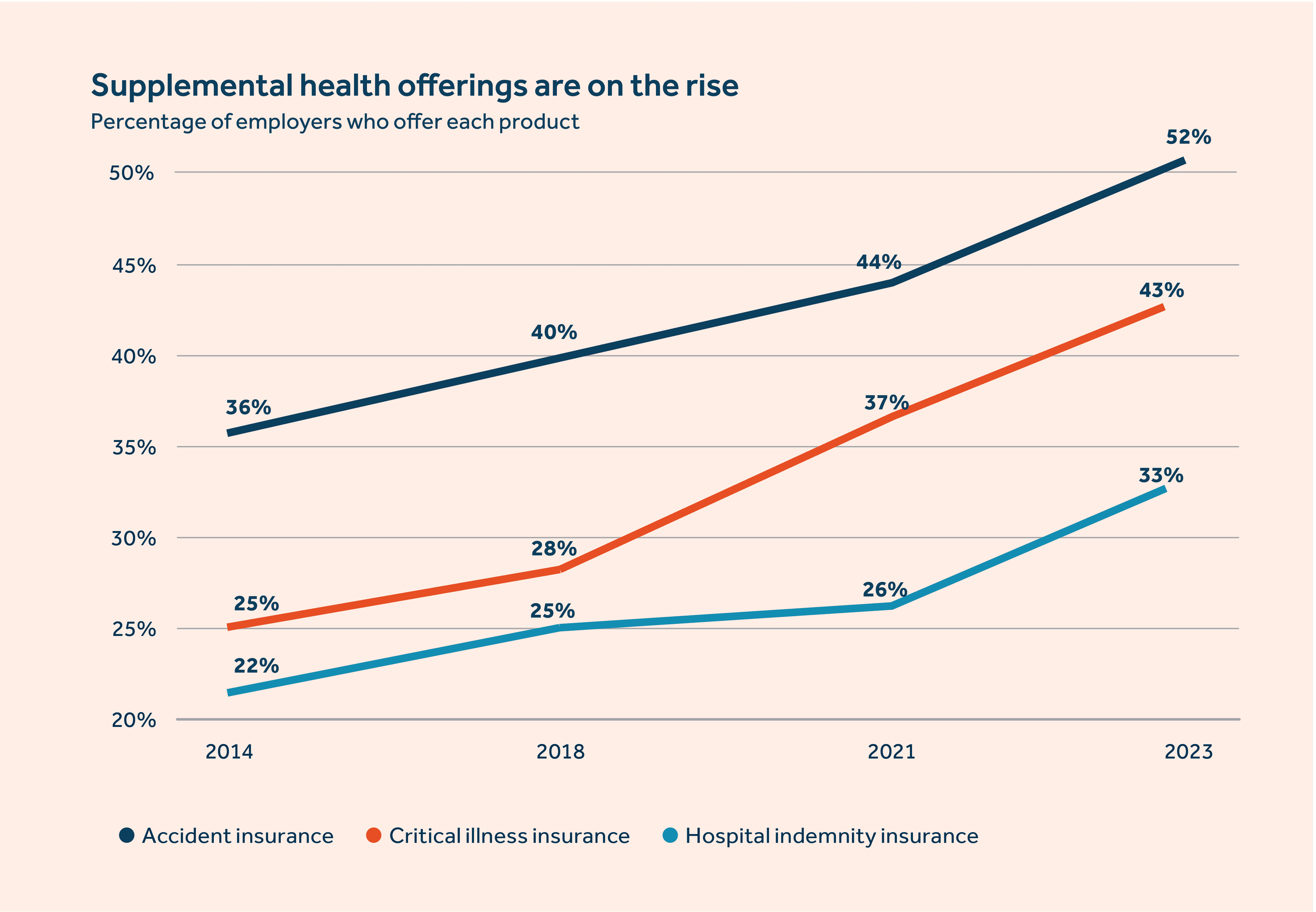

Many organizations want to better support employee well-being through enhanced policies and expanded resources, controlling benefits-related costs. One of the approaches employers are taking is offering more supplemental health insurance benefits options.

Employers offer supplemental health insurance to help boost employee's financial well-being

Many employers are turning to supplemental health benefits to boost employees’ financial wellness. Nearly half of Americans worry they’ll be bankrupted by a major health event, such as an ER visit or in-patient hospital stay.2 Just as many workers believe their health insurance plan isn't enough coverage for a major medical event.

As high deductible high plans (HDHPs) have grown, so have deductibles: the average deductible increased from $917 in 2010 to $1,673 in 2022.3 Yet, roughly half of working adults say they only have $2,500 saved for emergency medical expenses, and nearly 4 in 10 say they have less emergency savings than a year ago.4

Nearly 7 in 10 employers agree that supplemental health benefits help them meet employees’ need for greater financial security.

Self-reported financial and emotional wellness are higher among those who own supplemental health insurance than those who don’t. For example, 57% of employees who rate their financial health high own accident insurance compared to 45% who rate it low.

Supplemental health benefits help support overall employee well-being

The advantages of offering supplemental health insurance extend beyond helping employees cover medical costs. For example, 55% of workers who own accident insurance rate their emotional health highly, compared to just 45% of those with low self-reported emotional health.

Higher medical deductibles are also negatively influencing employee health care behaviors and could have consequences for workers' physical well-being, as workers take risks with their health to avoid out-of-pocket expenses.

More than 40% of workers in HDHPs indicate that they ignored medical advice or neglected their own care by doing at least one of the following: skipped scheduled doctor appointments, blood tests, X-rays, filling prescriptions or visiting the emergency room to avoid paying out-of-pocket costs toward their deductible.5 These decisions run the risk of putting their long-term physical and financial health at risk.

Fortunately, the percentage of employers offering supplemental health coverage through the workplace has grown steadily in the past nine years. More than half (52%) of employers now offer at least one supplemental health benefit—accident insurance, critical illness insurance, or hospital indemnity insurance.

Communication is key when offering supplemental health insurance

Simply giving an employee more benefits coverage choices isn't enough. The average employee is overwhelmed and confused by the widening array of coverage options, including supplemental insurance policies.

Therefore, a new approach is needed. Employers must provide a more guided benefits education and enrollment experience with upgraded omnichannel communication that offers a complete picture of supplemental health insurance.

Nearly half of all workers wish their employer offered digital decision-support tools to help them make more informed benefits choices.

The potential upside for both employers and employee are considerable: improved employee understanding and appreciation of their benefits, higher self-reported well-being, and more positive employee engagement and retention.

Read Guardian's report, “Benefits Optimization 2023: How supplemental health benefits and omnichannel communications support workforce well-being,” to learn what to prioritize in your supplemental health benefits program and how to communicate to employees during enrollment to set yourself up for success.

Stay at the forefront

Looking for more research, resources, and insights? Visit Guardian Edge to stay informed of the latest industry trends.