Financial highlights

Guardian continues to build on its legacy of financial strength, delivering consistent growth through a strong business strategy and disciplined risk management. Our commitment to value creation, prudent expense management, and sound capital allocation ensures we remain well-positioned to navigate evolving market conditions. As one of the most highly rated insurers in the US, we are poised to build on this momentum to support all of you — especially your financial wellness.

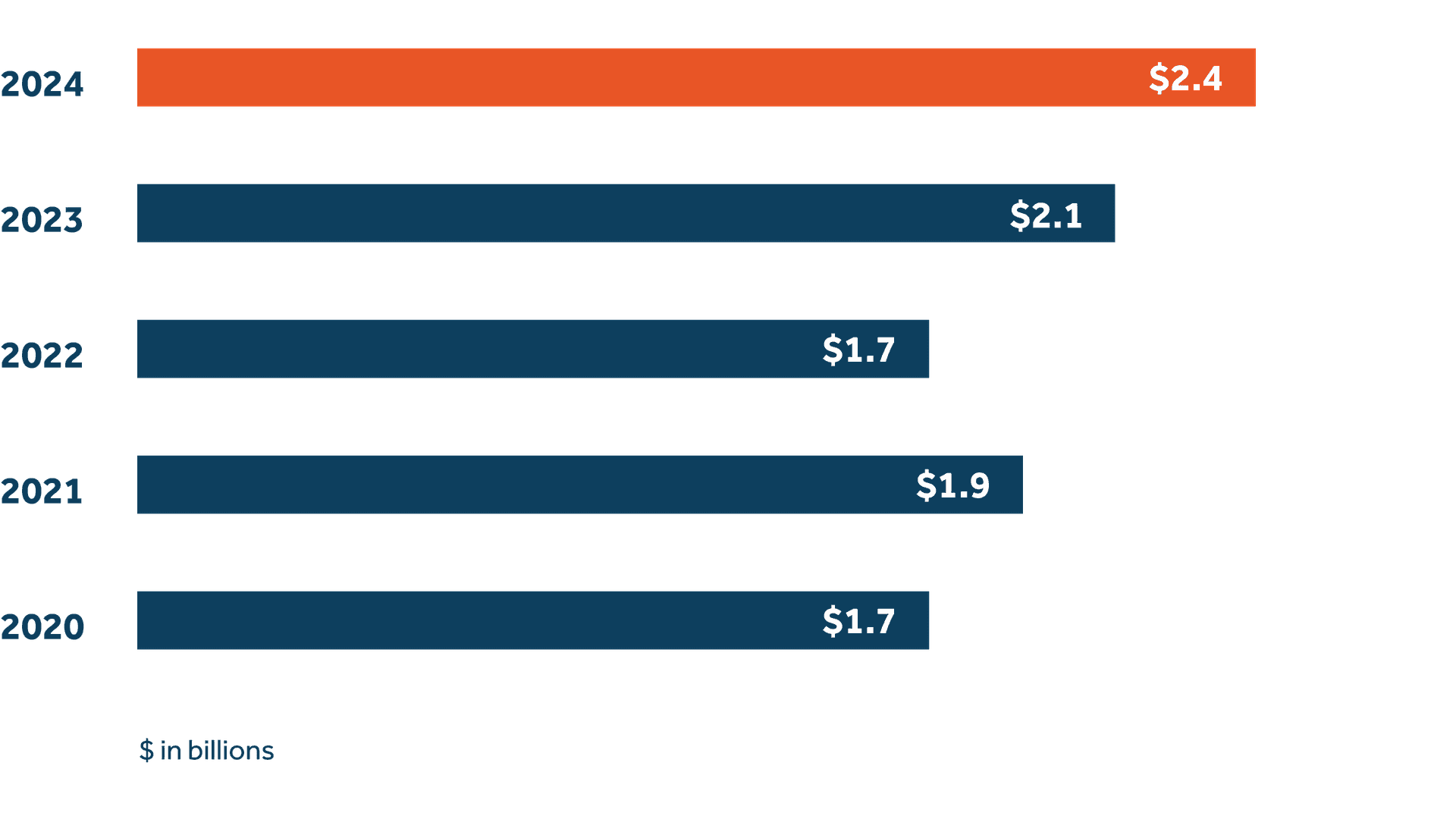

$2.4 billion

Achieved record operating income of $2.4 billion

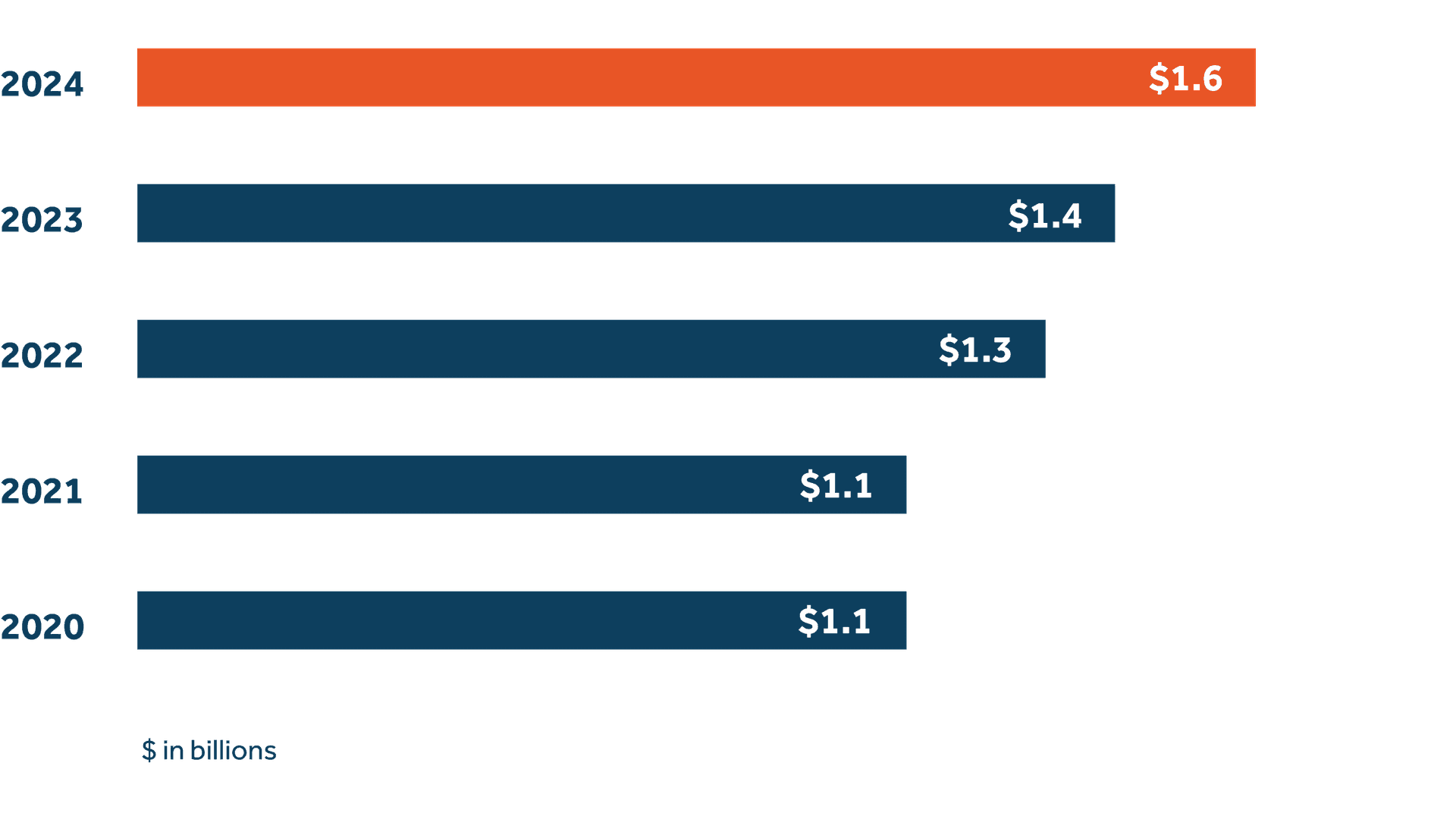

$1.6 billion

Delivered a record 2024 dividend of $1.6 billion to our participating policyholders, an increase of 14% from 2023*

A++

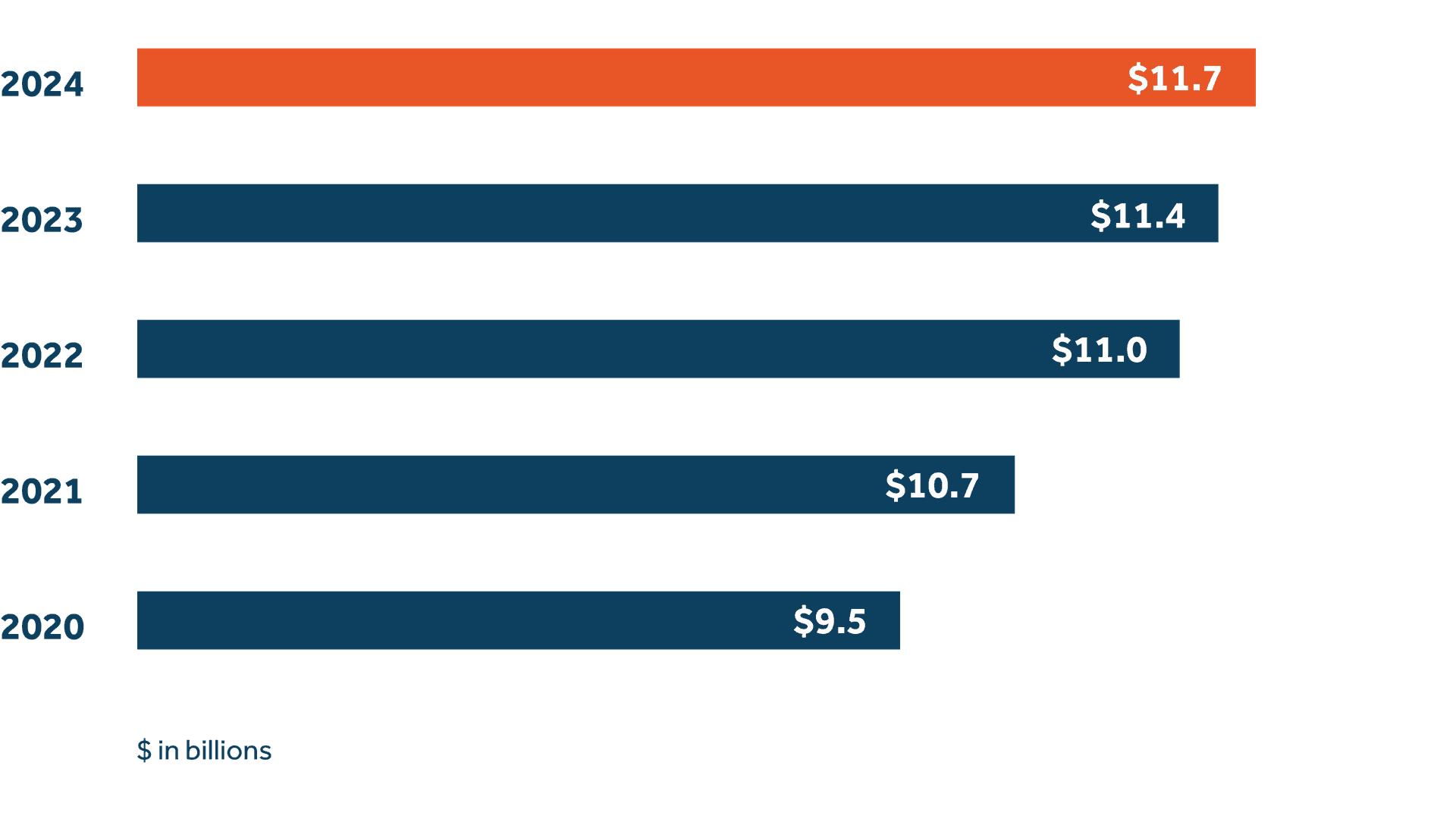

Proudly maintained our standing as one of the most highly rated insurance companies, with $11.8 billion of capital

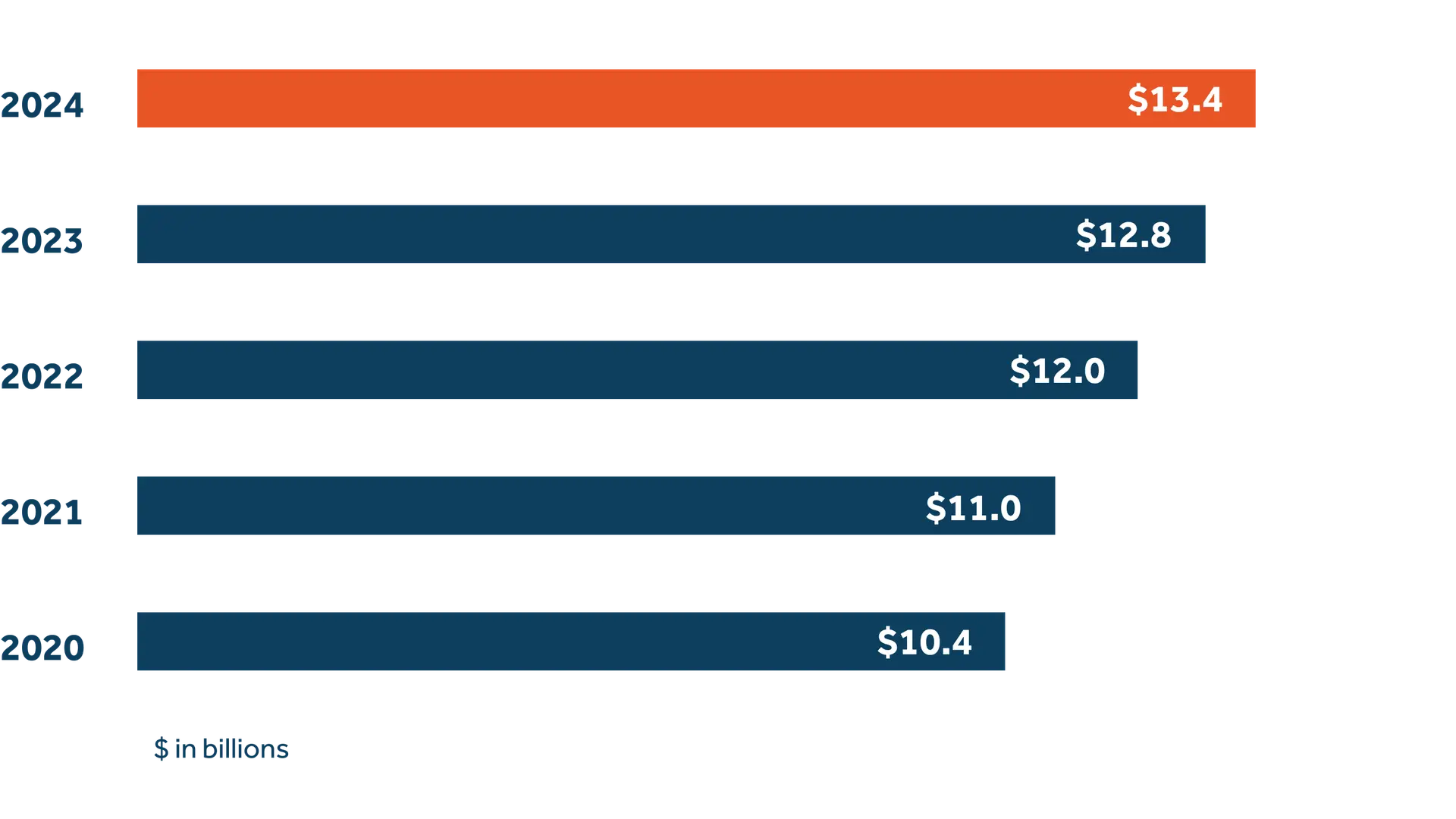

$13.4 billion

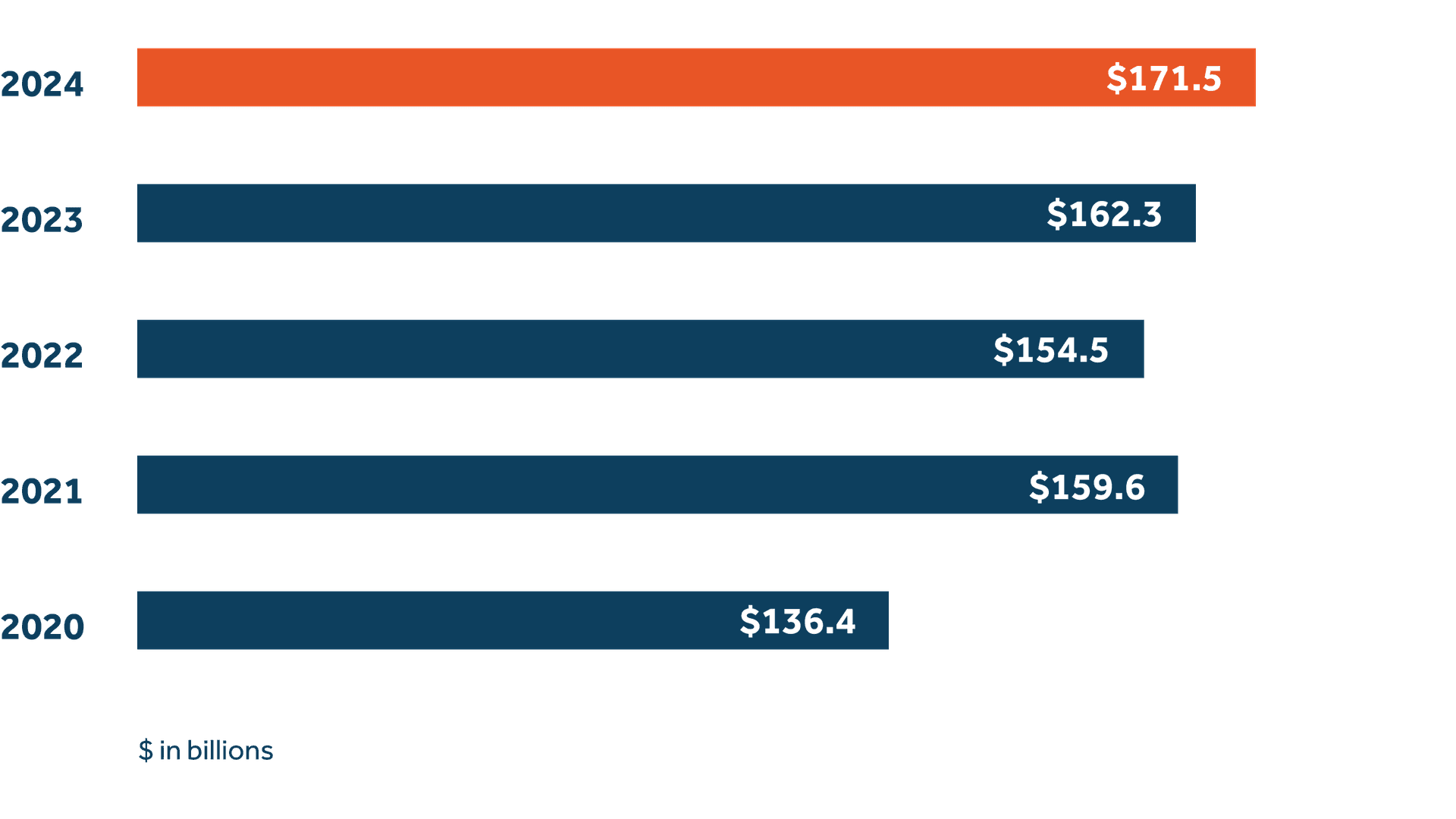

Achieved strong premium growth of 5%, with record sales in our Group Benefits and Individual Markets businesses

“Guardian’s financial strength remains a cornerstone of our success. Our strong operating performance and enhanced asset liability management leveraging our new Guardian Enginuity™: Next-gen risk optimization platform are driving above trend growth and further reinforcing Guardian’s financial strength. We are proud to continue delivering growth and protection for our policyholders, helping us meet our promises today and for the future.”

Kevin Molloy

Chief Financial Officer

Embracing innovation to understand risk

Guardian developed a next generation Asset Liability Management (ALM) platform — Guardian Enginuity™: Next-gen risk optimization — leveraging innovative technology to better understand risks and enhance returns for our policyholders. We have already seen initial benefits through our growing retirement income business including our popular fixed and income annuities.

Greater access, stronger returns

Guardian is enhancing the value we deliver to our policyholders by evolving our general account portfolio through an expanded partnership with HPS Investment Partners. This collaboration enables us to leverage HPS’ experience across a broad range of credit assets classes, strengthening our ability to generate superior risk-adjusted returns. With this new and innovative partnership, we are unlocking new opportunities to drive long-term growth and financial well-being for those we serve.

A year of strength in financial performance

We surpassed an operating income of more than $2.4 billion, an all-time record for Guardian, and maintained more than $11 billion in capital. This was driven by robust investment returns, sound underwriting, and prudent expense management.

As of December 31, 2024

Ratings

Ratings agencies are responsible for gauging the financial strength of companies so that investors, policyholders, or partners can work with the facts. Exemplary ratings help indicate that a company can honor its financial commitments and pay its claims.

Guardian continued its track record in 2024 of receiving high ratings across the board. **

- Moody’s Investors Service

Aa1

High Quality

2 of 21 - A.M. Best Company

A++

Superior

1 of 15 - Standard & Poor’s

AA+

Very Strong

2 of 20

Download the print edition

1 Dividends are not guaranteed. They are declared annually by Guardian's Board of Directors. The total dividend calculation includes mortality experience and expense management as well as investment results.

2 The ratings of The Guardian Life Insurance Company of America® (Guardian) quoted in this report are as of December 31, 2024 and are subject to change. The ratings earned by Guardian do not apply to the investments issued by The Guardian Insurance & Annuity Company, Inc. (GIAC) or offered through Park Avenue Securities LLC (PAS). Rankings refer to Guardian’s standing within the range of possible ratings offered by each agency.

* Certain amounts from 2023 have been reclassified to conform to the current year presentation.

Other legal information: Financial information concerning Guardian as of December 31, 2024, on a statutory basis: Admitted Assets= $86.8 Billion; Liabilities = $77.5 Billion (including $60.7 Billion of Reserves); and Surplus = $9.3 Billion.

Financial information concerning GIAC as of December 31, 2024, on a statutory basis: Admitted Assets = $10.6 Billion; Liabilities = $10.0 Billion (including $3.5 Billion of Reserves); and Capital and Surplus = $0.6 Billion.

Financial information for Berkshire Life Insurance Company of America as of December 31, 2024, on a statutory basis: Admitted Assets = $5.5 Billion; Liabilities $5.3 Billion (including $1.1 Billion in Reserves); and Capital and Surplus = $0.2 Billion.