How individual disability insurance can protect you

Individual disability insurance provides crucial financial protection that many professionals overlook until it's too late. While group disability policies offered through employers provide some protection, they often leave significant gaps in coverage. Here's why individual disability insurance matters and who needs it most.

Who needs individual disability insurance?

Higher-earning professionals have the most to lose from a disability. Group policies typically cap benefits, which may represent just a fraction of their actual income. This creates what many consider the “income gap”.

Even if you’re still early in your peak earning years, individual disability insurance is able to grow with you and an important step to protecting the income you’ve built so far.

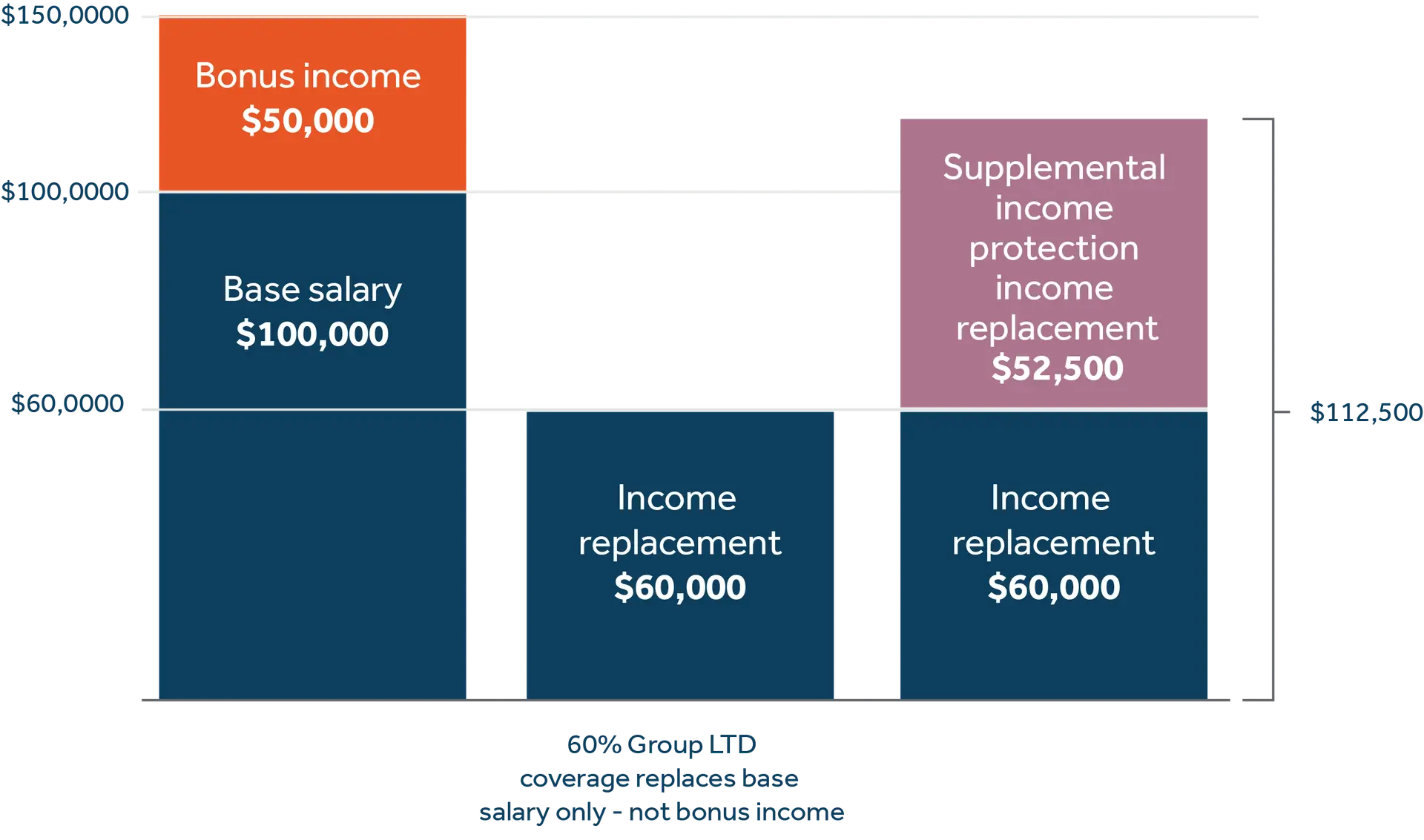

The income gap

Even if you have group or other long-term disability coverage, it may not be enough to maintain your lifestyle or pay your bills. We call this the income gap.

An individual disability insurance policy, like the one being offered to you, is a terrific supplement to the foundation that group LTD provides and can help ensure that you’re adequately protected.

Reasons to consider supplementing group coverage:

Coverage is generally basic and cannot be personalized to your individual needs because it is not individually owned.

Since coverage is not individually owned, you cannot take it with you when you change employers.

Group coverage can be changed or cancelled at any time by your employer or by the insurance provider.

Protecting the paycheck and career that you’ve built

Professionals have often invested heavily in their education and career development. Many have dedicated as much as many years to education and training, accumulating substantial student debt along the way. Individual disability insurance acknowledges this investment by providing more comprehensive protection of the income that the education and years of experience was designed to generate.

Maintaining financial commitments

Higher earners typically have correspondingly significant financial commitments—mortgages on primary and vacation homes, private school or college tuition for children, retirement contribution strategies, and other investments. Individual disability insurance helps ensure these commitments can be maintained even when income is interrupted by illness or injury.

Lifestyle preservation

Beyond basic needs, high-earning professionals often develop lifestyles commensurate with their income. Individual disability insurance helps prevent dramatic lifestyle adjustments during disability, preserving travel opportunities, recreational activities, and other quality-of-life factors that have become integral to personal and family identity.

Integration with wealth management strategies

Disability insurance is a critical component of comprehensive wealth management to ensure that a disability doesn’t derail carefully constructed roadmaps designed to build and preserve wealth. Individual policies are a holistic complement to investment strategies, retirement plans, and estate planning goals.

Take steps to protecting your income and lifestyle today

While group disability insurance provides a foundation of protection, individual disability insurance offers comprehensive coverage that truly protects your lifestyle and financial future. For professionals who have invested years in education and career-building, individual disability insurance isn't just an expense—it's an essential safeguard for your most valuable asset: your ability to earn an income.

Log in to see your personalized offer today in the enrollment link here.

7918706.1 20270531